The Federal Reserve’s upcoming policy measures to curb increasing inflation may be more challenging as a result of the faster-than-anticipated increase in September consumer prices in the United States.

According to data from the Bureau of Labor Statistics, the consumer price index (CPI) increased by a larger-than-expected 0.4% month over month and registered 3.7% on an annual basis, the same rate as in August. 3.6% and 0.3% were the readings that economists had predicted. The monthly underlying rate, which excludes volatile goods like food and energy, decreased to 4.1% from 4.1% in August and was in line with predictions.

The data comes at a time when Fed officials have been on the lookout for signals that this more restrictive policy has weighed on inflationary pressures. Fed officials have made slowing down rapid price increases a central target of an aggressive campaign of borrowing cost increases.

According to the central bank’s meeting minutes from September, members decided to “proceed carefully” with impending rate decisions. Officials highlighted the fact that they are particularly concerned about two big risks: not tightening policy enough to stop rising it and raising rates to a point where it affects wider domestic economic activity.

Importantly, the minutes did so before a recent jump in US Treasury yields since they represented the opinions of many Fed policymakers at the time. According to some officials, this increase may now need to be taken into account before making any rate decisions in the future. Fed Governor Christopher Waller suggested during a speech on Wednesday that the rise in yields may have actually done “some of the work” of tightening financial conditions for policymakers.

Want to Know more about inflation : Click here

I. What is Inflation?

It is an economic term that describes the sustained increase in the general price level of goods and services in an economy over a period of time. In simpler terms, it means that the purchasing power of a currency decreases as prices for everyday items rise. While this is a straightforward definition, the causes and consequences of this are more complex than meets the eye.

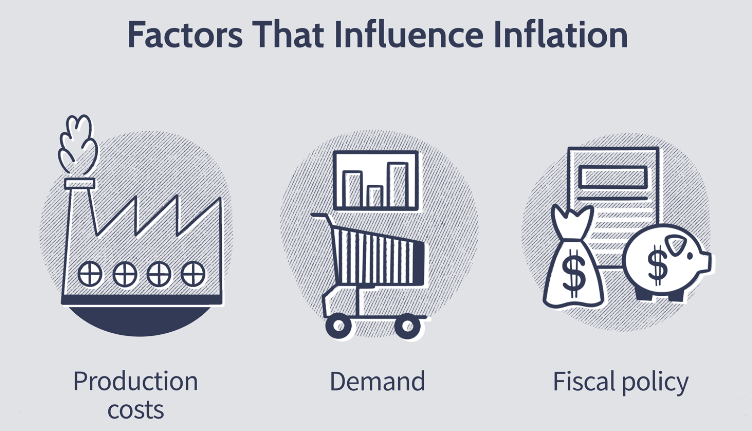

II. The Causes of Inflation

Understanding the causes of it is pivotal in comprehending its impact on economies and our daily lives. Several factors contribute to it, including:

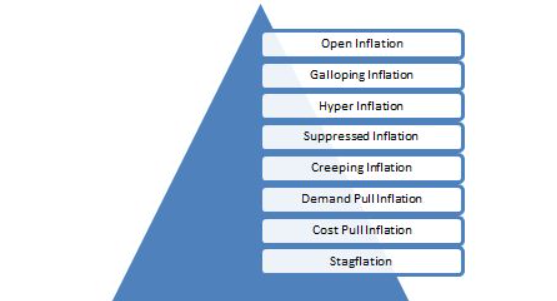

1. Demand-Pull Inflation

This type occurs when the demand for goods and services exceeds their supply. Consumers are willing to pay more for items in high demand, leading to a rise in prices.

2. Cost-Push Inflation

Cost-push arises when the production cost of goods and services increases. Factors like rising labor costs, increased prices of raw materials, or external shocks such as natural disasters can drive up costs and lead to inflation.

Also Read: UAE’s IHC increases its stake in Adani Enterprises to more than 5%

3. Built-In Inflation

Built-in inflation, also known as wage-price inflation, occurs when businesses and workers anticipate future price increases. This anticipation leads to wage demands and price hikes, creating a self-perpetuating cycle of inflation.

III. The Consequences

while inevitable to some extent in any economy, can have far-reaching consequences. These consequences affect various aspects of our lives:

1. Eroding Purchasing Power

As prices rise, the value of money decreases, which means you can purchase less with the same amount of money. This erosion of purchasing power can impact your standard of living and savings.

2. Uncertainty in Financial Planning

It can create uncertainty in financial planning. It becomes challenging to predict future expenses, especially when it’s rates are high, making long-term financial goals harder to achieve.

3. Economic Inequality

It can also exacerbate economic inequality. Those with fixed incomes or low wages may struggle to keep up with rising prices, while those with substantial assets or investments may see their wealth grow.

IV. Measuring Inflation

To gauge the impact of it accurately, economists rely on specific indicators. The most common measure of this is the Consumer Price Index (CPI). The CPI tracks the changes in prices of a basket of goods and services commonly bought by households, offering a snapshot of the overall cost of living.

V. Controlling Inflation

Economies aim to keep it in check to maintain economic stability. Central banks, such as the Federal Reserve in the United States, use monetary policy tools to control it. They may raise interest rates to reduce spending and curb inflation or lower rates to stimulate economic growth during periods of low inflation.

Also Read: Powerball Jackpot 2023: A Dream Worth Billions

image source: google