Diwali 2023 Top Nifty Stock: On Sunday, November 12, the stock exchanges BSE and NSE will hold a special one-hour trading session called “Muhurat” to commemorate the start of a new Hindu calendar year called Samvat 2080, which begins on Diwali. It is commonly held that trading at the “Muhurat,” or auspicious hour, benefits investors by bringing wealth and financial progress.

- OVERVIEW

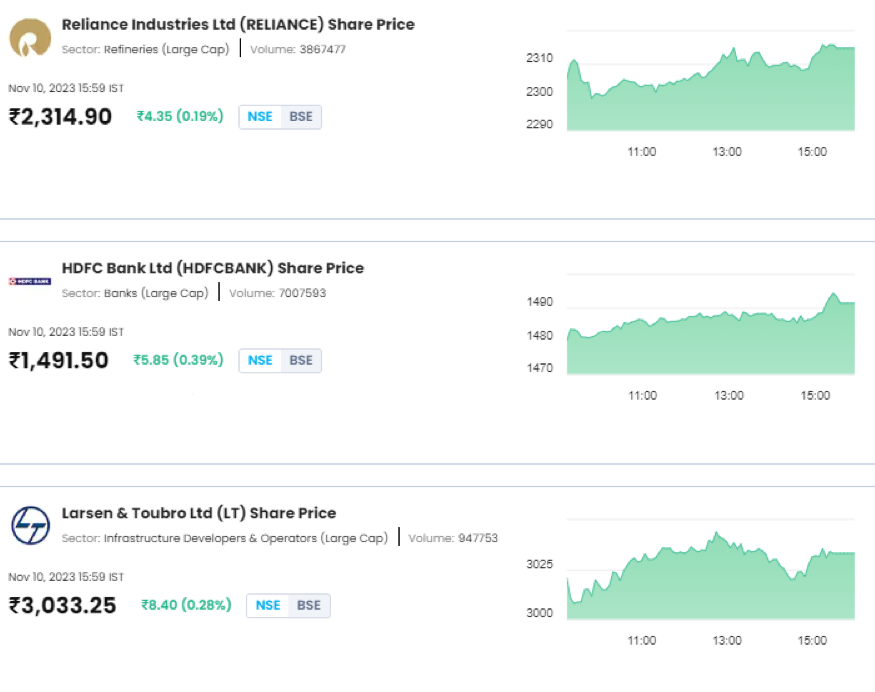

- For a 12-month term, an analyst has set a target price for RIL of Rs 2,900.

- The analyst stated that RIL’s profit margins are higher than those of its competitors.

- An expert in the market suggested a target price of Rs 1,964 at the HDFC Bank counter.

In Samvat 2079, Indian equities outpaced international markets, and in Samvat 2080, the outperformance is anticipated to persist. On Sunday, November 12, the stock exchanges BSE and NSE will hold a special one-hour trading session called “Muhurat” to commemorate the start of a new Hindu calendar year called Samvat 2080, which begins on Diwali. It is commonly held that trading at the “Muhurat,” or auspicious hour, benefits investors by bringing wealth and financial progress.

Business Today Markets (Online) has questioned experts from a few brokerages regarding their top picks for Nifty stocks over the course of a year in advance of the session. Satish Menon, Executive Director at Geojit Financial Services, stated that Reliance Industries Ltd (RIL) and HDFC Bank Ltd are probably going to gain in the medium- to long-term in response to the survey’s question.

Menon stated about RIL: “Crude price volatility and higher capital spending, which impair operating performance, are to blame for recent underperformance. Jio Platforms Ltd’s expanding subscriber base, data traffic, cost-effectiveness, national 5G services, JioAirFiber, and rising gas production are the cornerstones of RIL’s promising medium- to long-term prospects. Furthermore, the business’s inorganic and organic growth plan is unwavering. Despite flat revenues, the most recent quarter showed remarkable margin increase, indicating a favorable medium-term trend driven by a slowdown in oil prices.” He recommended setting a one-year target price on the RIL counter of Rs 2,641.

“We expect the NIM (Net interest margin) to have bottomed out and anticipate a gradual recovery in the near term,” the market analyst stated, discussing HDFC Bank shares. The medium- to long-term benefits of the merger with HDFC are probably in store. At this point, the valuation is more appealing.” He set a target price for the stock of HDFC Bank at Rs 1,964.

In response to BT’s query on the best stocks to buy, Nikhil Kapoor, Senior VP-Research at JM Financial Services Ltd., suggested RIL as well. “For Reliance, we anticipate that the long-term growth trajectory of its consumer-focused business would be strengthened by a cyclical upturn in the energy industry. When compared to competitors, RIL’s profit margins are higher. Given its complex asset portfolio and variety of feedstock sources, we identify unique hedging opportunities inside the O2C sector,” Kapoor said, setting a forecast price of Rs 2,900 for the upcoming year.

Larsen & Toubro Ltd (L&T) was the other stock that JM Financial’s Kapoor selected in his long-term selections. “We believe L&T is well positioned to benefit from sustained momentum in government funded domestic infrastructure projects, and order inflow from the Middle East; a pick-up in private capex, aided by the government’s push on manufacturing (PLIs + policy); and potential sale/financing of non-core power, road, and metro projects, which would improve balance sheet/return ratios,” he stated. For L&T, Kapoor set a target of Rs 3,430.

The companies that Arpit Jain, Joint Managing Director at Arihant Capital Market, believes have the best chance of outperforming the market are L&T, UPL Ltd., HDFC Bank, and Kotak Mahindra Bank. “L&T gains from heightened attention to infrastructure; UPL demonstrates tenacity in the agricultural industry; and HDFC/Kotak Bank symbolizes sound financial standing. These decisions strike a balance between industry-specific advantages and a broad perspective, according to Jain.

Click here, to check out the latest post on Instagram.

Also Read: Honasa Consumer Shares: 100% Profit Potential! Mamaearth Is A Strong Conviction ‘Buy’ At Jefferies, And The Stock Has Recovered

image source: google