Abercrombie & Fitch blew past expectations on Tuesday, reporting a 20% increase in revenue thanks to a robust back-to-school shopping season and growth at both its eponymous brand and Hollister.

- IMPORTANT NOTES

- Abercrombie & Fitch’s resurgence continues.

- Following another quarter of sales growth, the business boosted its full-year guidance yet again.

- The long-standing mall business is resisting an overall decline in the clothes industry.

The long-standing mall retailer, which has recovered from years of stagnation, has also upped its prognosis as it continues to defy a general slump in the garment market. However, the company’s stock dropped more than 5% in premarket trade. The stock was up 215% year to date as of Monday’s close.

Here’s how Abercrombie fared in its fiscal third quarter vs what Wall Street expected, according to an LSEG, now known as Refinitiv, survey of analysts:

- Earnings per share: $1.83 vs. $1.18 expected

- Revenue: $1.06 billion vs. $981 million expected

Also Read: Adani Wilmar Share Price: The Company’s Shares Recover From A One-Year Low And Close 5% Higher

The company’s net income for the three months ending Oct. 28 was $96.2 million, or $1.83 per share, compared to a loss of $2.21 million, or 4 cents per share, the previous year. Sales increased to $1.06 billion from $880 million the previous year. Abercrombie predicts net sales growth in the low double digits compared to the preceding year for the holiday quarter, which is in line with the 11.6% rise projected by analysts, according to LSEG.

According to StreetAccount, it expects its operating margin to be in the region of 12% to 14%, up from 7.7% in the prior year period and ahead of estimates of 11.3%. Higher gross profit margins, lower freight costs, and higher sales prices are projected to generate the expected increase.

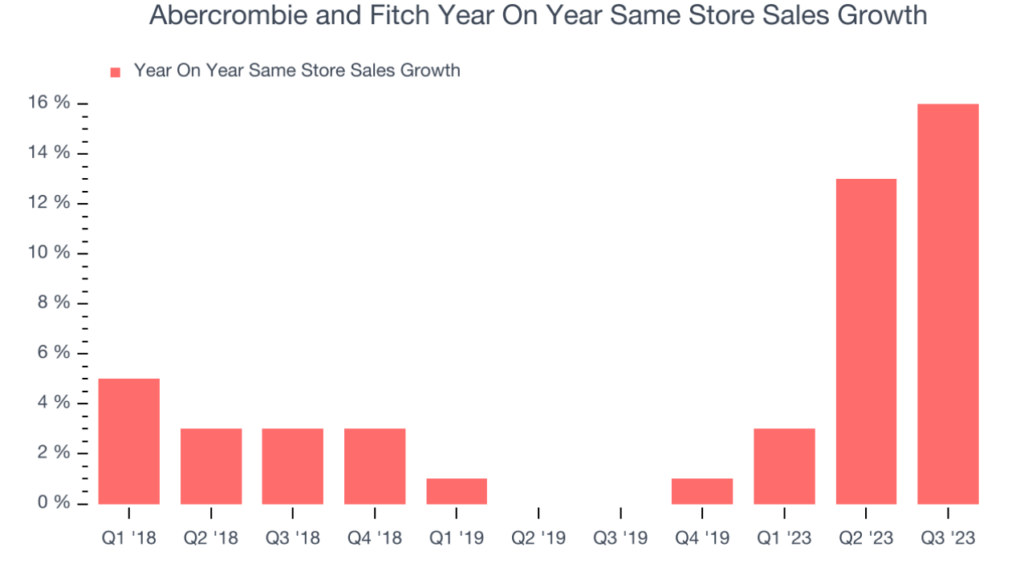

According to LSEG, the business anticipates net revenues to expand between 12% and 14% for the whole year, up from a previous forecast of approximately 10% and ahead of the 10.8% increase projected by analysts. According to StreetAccount, it is projecting an operating margin of roughly 10%, up from its previous range of 8% to 9%, which was what analysts predicted. Lower freight and raw material costs are likely to underpin the expected increase. During the quarter, Abercrombie’s name brand sales increased by 30% to $548 million, while Hollister revenue increased by 11% to $509 million. Same-store sales increased by 16% for both brands.

“Our strong third quarter results, with net sales and operating margin well exceeding our expectations, speak to the power of our playbook working globally across our brand portfolio,” Fran Horowitz, the company’s chief executive officer, stated in “As the holiday season approaches, our fiscal 2023 year-to-date results give us confidence that we can continue to deliver for our customers while driving profitable growth.” As a result, we are raising our full-year forecast for net sales growth and operating margin.”

Abercrombie’s stock has risen dramatically this year as the company’s turnaround bears fruit. Abercrombie has long been recognized for its branded t-shirts and trousers, as well as shirtless male models, prompting opponents to accuse the company of racism and exclusivity. Abercrombie has converted itself into an inclusive store with a product assortment that continues to resonate with consumers in the years since Horowitz took over as CEO.

Frequently asked questions

What is Abercrombie and Fitch revenue in 2023?

Historical Revenue (Quarterly) Data

| Date | Value |

|---|---|

| July 31, 2023 | 935.34M |

| April 30, 2023 | 835.99M |

| January 31, 2023 | 1.200B |

| October 31, 2022 | 880.08M |

What is the sales revenue of Abercrombie and Fitch?

$3.85 B

Abercrombie & Fitch’s current revenue (TTM) is $3.85 billion, according to the company’s most recent financial filings. The company’s sales in 2022 was $3.65 billion, a decline from $3.67 billion in 2021. The total amount of income generated by a corporation from the sale of goods or services is referred to as revenue.

What is the future of Abercrombie and Fitch?

Abercrombie & Fitch’s earnings and revenue are expected to grow by 22.4% and 4.3% per year, respectively. EPS is predicted to increase by 23.4% every year. In three years, the return on equity is expected to reach 21.5%.

Click here, to check out the latest post on Instagram.

Also Read: McDonald’s Stake: They Strengthen Their Minority Stake In The China Business

image source: google