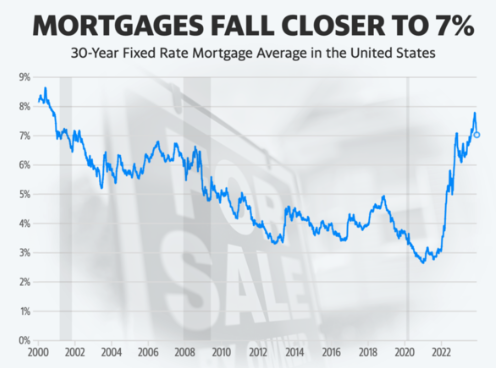

Mortgage rates fell again last week, resulting in savings for homeowners wishing to refinance.

- IMPORTANT NOTES

- Mortgage rates fell again last week, resulting in a 19% increase in refinance applications.

- Mortgage demand climbed as well, albeit at a far slower rate of 4%.

- Home prices remain high, and housing supply is limited.

According to the Mortgage Bankers Association, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) fell to 7.07% from 7.17%, with points falling to 0.59 from 0.60 (including the origination fee) for loans with a 20% down payment. This was the lowest reading since July.

“Mortgage rates fell last week as new data point to a slowing economy and support the Federal Reserve’s pivot to begin cutting rates next year,” said Mike Fratantoni, MBA senior vice president and chief economist.

Also Read: Stock Market Today: World Stocks Rise Ahead Of The US Consumer Price Index Update

As a result, refinance applications climbed 19% last week compared to the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. Refinance demand was 27% greater than the previous week.

“Borrowers who saw rates near 8% earlier this fall are now seeing rates as low as 7% quoted by some lenders.” Refinance activity increased in reaction to the rate decrease, with an especially noticeable increase in FHA and VA refinance applications,” Fratantoni remarked.

Mortgage applications for house purchases increased 4% for the week but remained 18% lower than the same week last year. Homebuyers today may benefit from reduced mortgage rates, but there is still stiff competition in a market with high prices and limited available properties.

Mortgage rates have not moved much this week since economic data has been consistent with forecasts. This could change on Wednesday, depending on the conclusion of the most recent Federal Reserve meeting and remarks from Chair Jerome Powell. Markets expect the Fed to maintain its target rate while cutting it next year.

Click here, to check out the latest post on Instagram.

Also read: IREDA Share: Within 10 Days Of Listing, It’s Shares Tripled From Their IPO Price, How Much Higher Can They Go?

image source: google