Maersk has banned transportation via the Red Sea and Suez Canal, two of the world’s most vital maritime commerce routes, “until further notice” as it reviews security following an attack on one of its ships.

The longer embargo underscores worldwide shipping firms’ anxiety over attacks on ships in the Red Sea by Iranian-backed Houthi terrorists who claim to be retaliating for Israel’s military war against Hamas. A long-term campaign targeting commercial vessels might destabilize the global economy by delaying the delivery of goods, fuel, and food, as well as raising prices.

Following the weekend attack on Maersk Hangzhou by Houthi rebels, the Danish shipping corporation first implemented a 48-hour suspension in transits across the Red Sea beginning Sunday. The attack occurred just days after Maersk started sailing in the area following the establishment of an international naval mission led by the United States to protect shipping.

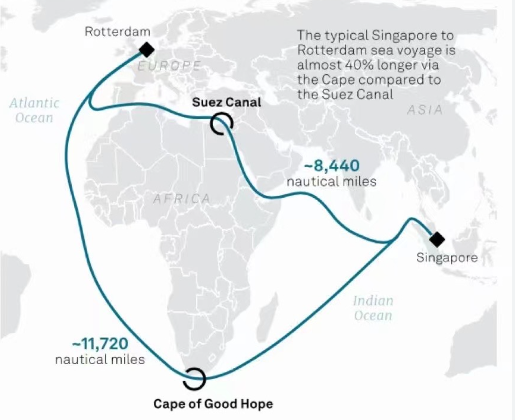

“An investigation into the incident is ongoing, and we will continue to pause all cargo movement through the area while we further assess the constantly evolving situation,” Maersk said in a statement released on Tuesday. It further stated that in some situations, vessels will be redirected around South Africa’s Cape of Good Hope.

A timetable posted late Monday on Maersk’s website revealed that more than 100 of its vessels traveling in the coming weeks have been redirected, highlighting the fragile state of one of the world’s most important commerce routes. The Suez Canal, which connects the Red Sea and the Mediterranean Sea, transports up to 30% of global container traffic.

Due to Houthi threats, several large shipping companies, including Hapag-Lloyd, Evergreen Line, and MSC Mediterranean Shipping Company, have also stopped using the crucial canal. Global supply chain instability is already increasing freight costs and lengthening delivery times.

“Longer trips for diverted services imply longer lead periods for importers and the possibility of port congestion.” There have been no reports of backlogs so far,” said Judah Levine, head of research at logistics firm Freightos.

Maersk began shipping via the channel again around Christmas after the Maersk Hangzhou was hit by “an unknown object” as it traveled through the Bab al-Mandab Strait at the southern entrance to the Red Sea en route from Singapore to Port Suez in Egypt.

“After the initial attack, four boats approached Maersk Hangzhou and opened fire in an attempt to board the vessel,” the business stated in a statement. According to the US military, its helicopters reacted to distress calls from the vessel and sank three Houthi-operated boats, killing all aboard. According to the report, a fourth boat escaped the area.

CMA CGM, a French shipping company, announced last week that it would progressively expand the number of ships passing the Suez Canal. On Tuesday, the business declined to comment more, directing to its December 26 statement. Meanwhile, Hapag Lloyd of Germany warned that, despite recent “incidents,” its ships would continue to sail around the Cape of Good Hope. “We are closely monitoring the situation day by day, but we will continue to reroute our vessels until January 9th,” a business spokeswoman told reporters Tuesday.

Freight rates and stock prices rise

Maersk and Hapag-Lloyd shares rose on the first trading day of the new year, possibly buoyed by anticipation that the companies will be able to lock in higher shipping prices through 2024. At 11:30 a.m. ET, Hapag-Lloyd was up 3.6%, while Maersk was up 6.4%. In recent weeks, both corporations have announced new fees for transporting cargo along several of the world’s biggest commerce routes.

According to Freightos data, the cost of shipping a standard 40-foot container from Shanghai to New York has risen to nearly $5,000 on average this week, up from $3,500 in the middle of December. Sending the same-size container from Shanghai to Rotterdam, Europe’s main container port in the Netherlands, will cost roughly $2,400, up from $1,800 last year.

According to Levine of Freightos, “all-in prices” of $5,000–$8,000 per container for main trade routes beginning in Asia would be 2.5–4 times higher than “normal levels” for this time of year. Despite the large increase, he added, it is still 45%–75% below their “pandemic peak” in late 2021.

Click here, to check out the latest post on Instagram.

Also read: Mastering Buyer Problem: Strategies For Effective Solutions

image source: google