After a three-year plus hiatus due to the pandemic, federal student loan holders must resume making payments this month.

After a three-year or more hiatus owing to the pandemic, borrowers of federal student loans must resume making payments this month. At least 21 days before your due date, you should anticipate receiving a bill that details the amount you must pay each month. Most borrowers have probably already gotten their bills, but if you haven’t, go to your loan servicer account. In September, interest once again began to accumulate. Do not become anxious if you have student loans and have not made a payment in the past three years. The advice of specialists is as follows:

Where do I start?

To find out who your loan servicer is, log into your StudentAid.gov account first. You might have a different loan servicer now than you did in March 2020, according to Amy Czulada, outreach and advocacy manager at the Student Borrower Protection Center. This is because many loan servicers changed during the epidemic.

Once you are aware of your loan servicer, you can go into your account with them to view the balance, frequency, and interest rate of your student loans. In order to determine which income-driven repayment plans you might be eligible for, Czulada also advised that you consider the type of student loans you currently have. In order to ensure that you receive any necessary correspondence, last but not least, update your personal information in your account with your loan servicer.

How do I know what my payments will be?

On their account with their loan servicer, borrowers can view the amount of their monthly student loan payment. By going into your studentaid.gov account, you can learn who your servicer is if you don’t already know.

What if my payments are too high?

You have a few options if you anticipate having trouble making payments once they start up again. President Joe Biden established a 12-month grace period this summer to assist borrowers who experience difficulty once payments resume. During the first year after payments resume, you can and should make payments, but if you don’t, you won’t be in default danger and it won’t lower your credit score. Whether you make payments or not, interest will continue to accrue.

You should check to see if you are eligible for an income-driven repayment plan, advises Betsy Mayotte, president of The Institute of Student Loan Advisors. The loan-simulator tools at StudentAid.gov and TISLA’s website can both be used by borrowers to identify the payment schedule that best suits their requirements. Calculators reveal this.

What’s an income-driven retirement plan?

Based on your salary and family size, an income-driven repayment plan establishes your monthly student loan payment at a level that is meant to be reasonable. Most federal student loans are eligible for at least one of these programs, and it takes into consideration various budgetary expenses.

In an income-driven repayment plan, your monthly payment is often a proportion of your discretionary income. Your monthly payment can be $0 if your income is low enough. A new income-driven repayment scheme was unveiled by the Biden administration last year. Some of the most forgiving conditions ever are provided by the SAVE plan. As long as borrowers make timely payments, interest won’t accumulate under this scheme.

The SAVE plan may still be subject to legal objections akin to the ones that caused the Supreme Court to reject Biden’s call for widespread student loan cancellation.

Are there any other programs that can help with federal student loan debt?

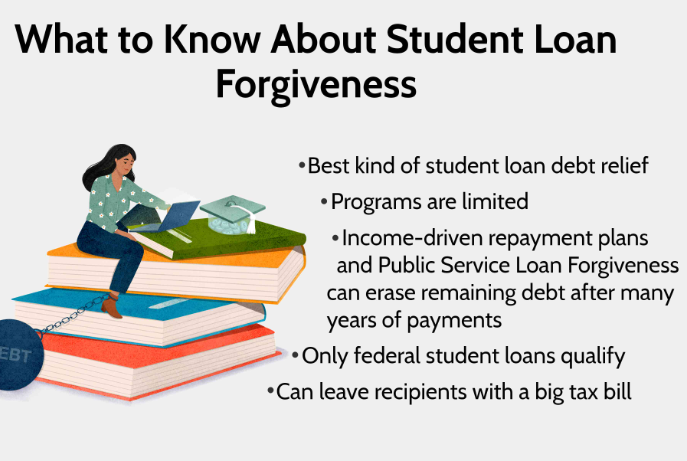

The Public Service Loan Forgiveness program allows cancellation after 10 years of consistent payments for borrowers who have worked for government or nonprofit organizations, and some income-driven repayment programs offer cancellation of the remaining balance of a borrower’s debt after 20 to 25 years.

To be eligible for these programs, borrowers must be enrolled in the best income-driven repayment plan available. Additionally, borrowers who have been taken advantage of by for-profit universities are eligible to petition for borrower defense and get assistance.

Filling out an application on the Federal Student Aid website is the first step if you want to repay your federal student loans through an income-driven plan.

HOW CAN I REDUCE COSTS WHEN PAYING OFF MY STUDENT LOANS?

The servicer reduces your interest rate by a quarter of a percent if you set up automated payments.

How do I enroll in automatic payments?

By using your loan servicer’s account, you can set up automatic payments. Prior to the payment suspension, borrowers who had automatic payments set up must re-enroll, according to Czulada.

WHAT ELSE SHOULD I KNOW?

Czulada advises being on the lookout for fraud. Never should you be required to pay to apply for any programs or to receive assistance with your loans. “You will never receive a phone call from the Department of Education. So, if you receive a call saying, “Hey, pay $100 now and your debt will be cancelled,” it’s a warning sign that it’s a scam, according to Czulada.

The Department of Education advises that you be aware of scammers’ official email addresses, look for mistakes in advertisements, and never divulge your log-in information.

Also Read: Millionaire Ryan Cohen Becomes GameStop’s New CEO And Expands His Chairman Responsibilities

image source: google