According to IHC, “This strategic increase reflects IHC’s conviction in Adani Enterprises’ globally renowned incubation model.”

International Holding Company (IHC), an Abu Dhabi conglomerate, announced on Tuesday that it has boosted its investment in Adani Enterprises Ltd. to more than 5%. “This strategic increase reflects IHC’s belief in the world-beating incubation model of AEL, and we believe that the inherent strength of the airports, data centers, green hydrogen, and various other verticals being incubated under AEL, as well as the fact that AEL is poised to specifically capitalize on India’s robust growth journey, IHC continues to explore unique investment opportunities in India with the goal to maximizing stakeholders’ returns,” said IHC in a press release. On Tuesday, Adani Enterprises’ scrip on BSE closed 0.9% lower at Rs 2,390.

“We are thrilled with IHC’s decision to increase its investment in Adani Enterprises Ltd. (AEL), which further validates AEL’s standing as a global leader in incubating new businesses, particularly in sustainable infrastructure, developing global aviation infrastructure, and equitable energy transition,” an Adani Group spokesperson said. We consider IHC’s larger shareholding as a strong validation of our thorough capex plans, governance, and openness. This intergenerational partnership with IHC is a positive reflection of India’s dynamic growth potential and provides significant returns for our stakeholders

IHC announced in a stock exchange notification last month that its companies had reached a deal to “dispose of” their foreign direct investment in Adani Green Energy Ltd. and Adani Energy Solutions (formerly Adani Transmission) to a buyer. According to data from the Bombay Stock Exchange, the move is a part of IHC’s “portfolio rebalancing strategy” and would see its subsidiaries Green Energy and Green Transmission sell their respective stakes in Adani Green and Adani Energy Solutions (1.26% and 1.41%, respectively).

According to IHC, the company’s disclosure to the market is in line with its plan to rebalance its investment holdings. “Our commitment to the Indian market and our partnership with Adani remain steadfast.” In response to claims made by US short-seller Hindenburg Research in January that the apples-to-airports conglomerate participated in stock manipulation and had accumulated noticeably large debt, international investors like the IHC have backed Adani.

The Adani Group has refuted every accusation, and the Indian market regulator is looking into the situation at the Supreme Court’s request. IHC had invested in the renewables division Adani Green Energy and the power company Adani Transmission in April 2022. In addition, IHC had invested an additional $1 billion in the group’s flagship, Adani Enterprises. Syed Basar Shueb, the chief executive of IHC at the time, referred to the choice to support Adani as a “long-term investment in India.”

Also Read: Manhattan Is Experiencing A Lack Of Luxury Apartments, Which Is Increasing Costs

Adani Enterprises: A Leading Force in Sustainable Business

In the realm of global corporations, few names shine as brightly as Adani Enterprises. With a commitment to sustainability, innovation, and growth, Adani Enterprises has emerged as a prominent player in various sectors, making its mark on both national and international stages. In this comprehensive article, we delve into the intricacies of this remarkable conglomerate, highlighting its diverse portfolio, sustainable practices, and unwavering dedication to excellence.

A Brief Introduction to Adani Enterprises

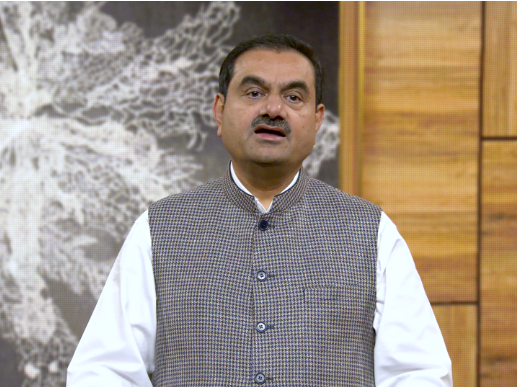

Adani Enterprises, a subsidiary of the Adani Group, stands as a symbol of India’s indomitable spirit and ambition. Founded in 1988 by Mr. Gautam Adani, this conglomerate has grown exponentially, traversing numerous industries such as energy, infrastructure, logistics, and agriculture.

Energy Pioneers:

Under the visionary leadership of Mr. Gautam Adani, Adani Enterprises has made substantial strides in the energy sector. Adani Power, a subsidiary, is a frontrunner in thermal and renewable energy generation, contributing significantly to India’s power needs. The company’s commitment to clean and sustainable energy aligns perfectly with global environmental goals.

Infrastructure Marvels:

Adani Enterprises has been instrumental in transforming India’s infrastructure landscape. Their flagship project, Mundra Port, stands as a testament to their dedication to development. Mundra Port, the largest commercial port in India, has facilitated trade and economic growth, fostering connectivity and global partnerships.

Logistics and Agri-Infrastructure:

Adani’s foray into logistics and agri-infrastructure has been a game-changer for the Indian economy. Adani Agri Infrastructure Network Limited (AAINL) and Adani Logistics Limited (ALL) have streamlined the supply chain, making the transportation of goods more efficient and cost-effective.

Sustainability at the Core

In an era where environmental consciousness is paramount, Adani Enterprises has taken commendable strides to integrate sustainability into its operations.

Renewable Energy Initiatives:

Adani Green Energy, a subsidiary, is at the forefront of India’s renewable energy revolution. The company has made significant investments in wind and solar power, aiming to reduce the carbon footprint and mitigate climate change effects. Their ambitious goal of achieving 25 GW of renewable energy capacity by 2025 is a testament to their commitment.

Environmental Stewardship:

Adani’s environmental stewardship goes beyond their business operations. They actively engage in afforestation programs, conservation efforts, and water management initiatives. These endeavors not only benefit the environment but also contribute to the well-being of local communities.

Global Outreach and Partnerships

Adani Enterprises’ global reach extends far beyond India’s borders. With strategic investments and partnerships, they have solidified their position on the international stage.

International Ventures:

Adani’s acquisition of Australia’s Abbot Point Terminal and Carmichael coal mine showcases their global ambition. These ventures not only bolster the Australian economy but also strengthen India’s energy security.

Partnerships for Progress:

The Adani Group has formed strategic alliances with global giants like TotalEnergies and Wilmar International, further expanding its presence in the energy and agri-business sectors.

Future Prospects

Adani Enterprises’ future prospects look promising, with a relentless focus on growth, sustainability, and innovation.

Diversification Strategy:

The company continues to diversify its portfolio, exploring new avenues such as data centers, defense, and aerospace. These ventures are poised to drive growth and contribute to India’s economic development.

Global Leadership:

Under Mr. Gautam Adani’s visionary leadership, Adani Enterprises is set to become a global leader in various sectors, solidifying its position as a force to be reckoned with.

Also Read: Today’s Stock Market: Asian Shares Mixed As US Shutdown Avoided And Japan Business Confidence Rises

.