Bajaj Auto’s overall revenue for the second quarter of FY24 was Rs 11,206.84 crore, up from Rs 10,536.56 crore in the prior quarter.

According to a BSE filing, Bajaj Auto Limited’s consolidated net profit for the second quarter of the current fiscal year (Q2FY24) increased by 17.48% to Rs 2,020.05 crore from Rs 1,719.44 crore for the same quarter the previous year. The net profit increased by 22.86% sequentially. The company’s net profit in Q1FY24 was Rs. 1644.14 billion.The income from operations for the second quarter of fiscal year 24 (Q2FY24) was Rs 10,838.24 crore as opposed to Rs 10,202.71 crore year over year (YoY), an increase of 6.22 percent. Revenue from operations increased 5.1% from quarter to quarter. In Q1FY24, it was Rs 10,311.91 crore.

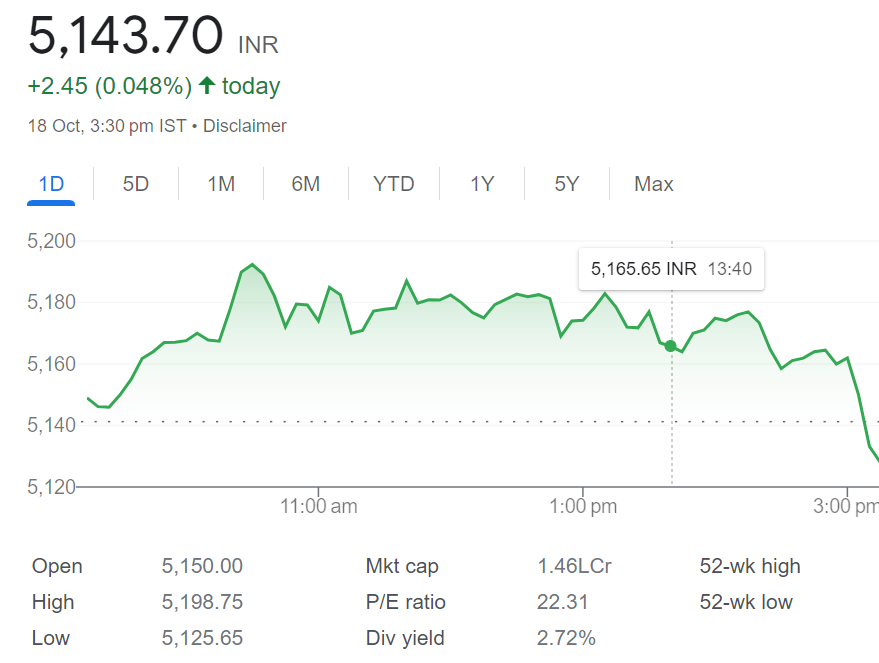

The total revenue for Q2FY24 was Rs 11,206.84 crore, up 6.36 per cent from Rs 10,536.56 crore year over year. The overall income increased 5.1% from Q to Q. In Q1FY24, it was Rs. 10,663.01 billion. According to a press release from the corporation, as of September 30, 2023, it had Rs 17,326 crore in excess money. In spite of the unstable market, the company’s exports gradually improve as its volume increases by 8% consecutively. On Wednesday, shares of Bajaj Auto Limited closed at Rs 5,143.7.

Bajaj Auto, whose iconic motorcycles include the Dominar, Pulsar, and Avenger, recorded a standalone net profit of Rs 1,836.1 crore for the July-September period, a 20% year-on-year increase that above analysts’ forecasts. The strong quarterly profit was driven by higher sales of margin-boosting three-wheelers and luxury motorcycles.

Also read: As Wealth Management Results Disappoint, Morgan Stanley Shares Decline By 5%

The automaker’s revenue from operations increased by 5.6% to Rs 10,777.3 crore in the second quarter of the current fiscal year, the slowest growth in three years. Bajaj Auto’s quarterly net profit was anticipated to be Rs 1,725 crore, with revenue of Rs 10,800 crore, according to research.

During the three-month period, Bajaj Auto’s entire sales volume fell by 8%, with the two-wheeler segment falling by 13%. Ahead of the results, the company’s shares closed 0.1% lower at 5,137.35 rupees. Among the country’s two-wheeler manufacturers, Bajaj Auto was the first to disclose quarterly results. The company’s stock closed slightly in the green on the BSE, at Rs 5,143.8 per share, ahead of the earnings announcement.

Bajaj Auto shares: Past performance

Bajaj Auto shares closed the September quarter 7.9 percent higher, compared to the Nifty50 index, which gained 2.3 percent.EBITDA (earnings before interest, taxes, depreciation, and amortization) was Rs 2,133 crore. For the first time, quarterly EBITDA exceeds Rs 2,000 crore, representing a 21% year-on-year increase. The operating margin was 19.8%, up over 260 basis points year on year, driven by higher realization and a more diverse product mix, which more than offset the negative from investments in expanding electric scooters.

Exports remain on track for a gradual recovery despite unpredictable market conditions, with volumes up 8% sequentially, according to the business. The market share remains stable, with volume increases in Africa, LATAM, and SAME allowing for a little buildback of inventory in certain regions; actions to handle currency limits and adverse macroeconomic conditions in foreign markets continue unabated.

Strong cash generation was maintained, with over Rs 3,600 crores of free cash flow added in the first half, 1.6 times more than in FY23. The corporation has a strong balance sheet, with excess capital of Rs 17,326 crore as of September 30, 2023, after distributing Rs 4,000 crore in dividends during the quarter. On the NSE today, Bajaj Auto Ltd. shares closed 0.048% higher at Rs 5,143.70 per share. The stock has increased by 45% since the beginning of the year, making it the fourth-highest performer on the Nifty 50 index.

Click here to learn more about Bajaj Auto.

Also Read: Netflix Earnings: User Growth Will Show That The Most Recent Correction Created A Buying Opportunity

Disclaimer: Note that none of these shares are owned by the author. This information is provided for informational purposes only and should not be construed as investment advice.

image source: google