- ESSENTIAL POINTS

- Food corporations are placing large bets on snacking, but the emergence of medications like Wegovy, Ozempic, and others could endanger future sales growth.

- By 2035, Morgan Stanley predicts that roughly 7% of Americans, or 24 million people, will be taking GLP-1 medications.

- But before that occurs, PepsiCo, Mondelez, and other food firms might be able to change their portfolios.

Big Food’s wager on snacking started about ten years ago, and it has only grown as sales in the other supermarket aisles stagnate, especially as prices climb. According to HSBC, sales of sweet snacks are anticipated to increase by 4.6% annually, and the market for savory snacks is anticipated to grow by 6% annually from 2022 through 2027. According to Accenture data, around three-quarters of consumers intend to snack every day.

Frosted cornflakes have been the cornerstone of Kellogg’s business for more than a century. On Monday, the company will rebrand as Kellanova and sell off its steady cereal business in favor of its faster-growing snack section. The split comes weeks after J.M. Smucker purchased Twinkie manufacturer Hostess Brands for $5.6 billion in an effort to expand its snack lineup, making another bet that consumers will nibble in between meals.

However, investors are worried about the impending threat posed by Big Pharma’s popular obesity and diabetes medications, Wegovy and Ozempic, which is why food businesses are placing such large investments in eating. Although many investors have great expectations for the future of pharmaceuticals, their success may result in slower sales for the companies that make Oreos, Doritos, and Hershey’s Kisses.

Consumers in Generation Z and Millennials are driving the trend. According to Kelsey Olsen, a food and drink expert for market research company Mintel, younger generations snack more frequently than older consumers. Consumers in the Millennial and Gen-Z generations frequently eat smaller, more frequent meals, which gives them more opportunities to grab a snack.

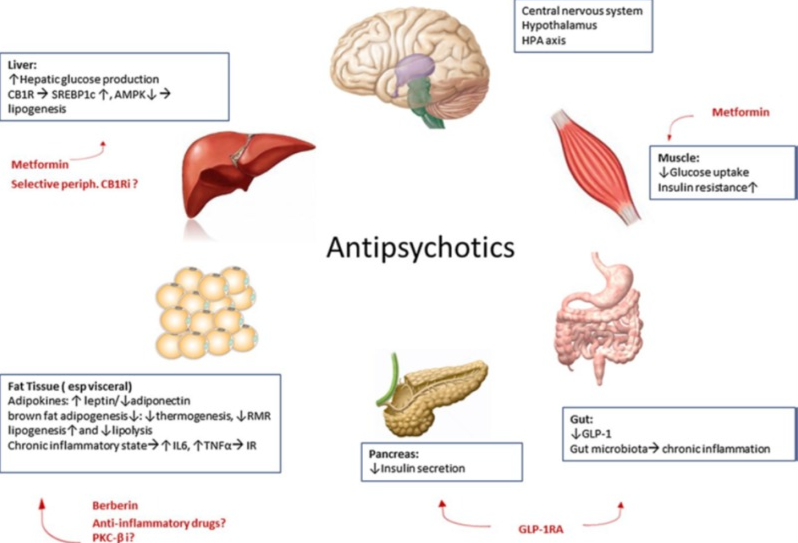

At the same time, Novo Nordisk’s Ozempic and Wegovy have soared thanks to prescriptions for weight-loss aids for patients. The medications, referred to as GLP-1 agonists, reduce appetite by imitating a gut hormone. Many well-known snack brands fall into the category of meals with a greater sugar and fat content, and some patients even report developing aversions to these items.

According to a Trilliant Health research, more than 9 million prescriptions for these medications were written in the U.S. during the fourth quarter of 2022.By 2035, roughly 7% of Americans, or 24 million individuals, could be on GLP-1 medications, according to Morgan Stanley’s projection.

If this is the case, the consumption of salty and sweet snacks may decline by 3%, or even more, if the new eating patterns of the patients spread to their wider households and social circles, according to research from Morgan Stanley. Risky businesses affected by this include Hershey, Mondelez, PepsiCo, General Mills, and Kellogg’s successor, Kellanova.However, not everybody in the sector concurs with that conclusion.

Also Read: Adani Total Gas, Mirza International, And More: This Stock Decline Has Reached 83% So Far In 2023

The uptake of weight-loss drugs could be slow

Smucker CEO Mark Smucker defended the survival of Twinkies and Ding Dongs against the threat of GLP-1 medications after purchasing Hostess Brands.The consumer will continue to snack in a variety of ways. We believe our estimates are accurate given that customers will continue to seek out a variety of snacks, and sweet snacks will remain popular, he said in a conference call with analysts.

For starters, GLP-1 medications like Wegovy and Ozempic cost about $1,000 per month on the list. Some insurers have decided not to cover the therapies as a result of the high cost. Despite the fact that some of the biggest insurers in the country, such as CVS’ Aetna, pay for the prescriptions for these medications, the federal Medicare program, several state Medicaid programs, and other commercial insurers don’t, leaving the patients responsible for the costs.

Sales of snacks could benefit from a different factor. The majority of those who consume the most junk food will probably not be able to afford Wegovy or Ozempic. “Consumption of indulgent salty snacks that would be considered ‘junk food’ generally over-indexes toward lower-income individuals, who are unlikely to be these drugs’ primary users,” RBC analyst Nik Modi said in a research note on Tuesday.

According to Modi’s writing, the medications won’t eventually pose a problem for the producers of salty snacks. Additionally, patients must administer their own injections once per week, and if they stop using the therapies, the effects cease working, frequently reversing whatever weight loss that has been achieved gradually.

Oliver Wright, senior managing director of Accenture’s consumer goods and services unit, said, “This sort of drug is super interesting in what it can do, but I think until it comes in a radically different formulation, in a pill or something like that, and something that has enduring impact and obviously the much lower price point, I think it’s going to be tricky.” It will take time for the situation to alter, even if the drugs are more commonly used and more reasonably priced. The food industry will have time to adapt to changing customer habits.

“We acknowledge that the impact in the near term is likely to be limited given that drug adoption will grow gradually over time, but we could see a longer-term impact as drug prevalence increases,” Paula Kaufman of Morgan Stanley said in a letter to clients. Additionally, we anticipate that businesses will use innovation and portfolio restructuring to react to changes in customer behavior.

This could result in less rapid sales growth than anticipated and plans to exit some brands. However, Big Food has been working to offer healthier alternatives. GLP-1 medications might merely increase the pressure on businesses to revamp their product lines.

Several corporations have bought up smaller brands that produce healthier food, like PepsiCo and Mondelez. It will take time for them to develop into global superpowers, though. Food manufacturers are also going inside, investing in their R&D groups to develop new formulations that mimic the flavor of their fully salted and sugared versions. By the end of the decade, consumers won’t be able to distinguish between a new, healthier Oreo and an old, unhealthy one, which will be a good thing, according to Accenture’s Wright.

What Is ‘Big Food’ and Why Should We Care?

Consumers who are more thoughtful are becoming increasingly prevalent. We are learning more about ethical behavior, sustainability, and health. And as a result, we’re developing into savvier, more knowledgeable consumers. We’re expecting more from food companies, and we want them to share our beliefs.

A increasing mistrust of huge, industrial food producers is occurring at the same time as this. As a result, the trend toward smaller, independent, local food brands is picking up speed. Large-scale food production is more economical. Not much else gains, just our wallets. The environment, animals, and farmers all suffer when there is nothing in the way of financial gain.

Sadly, not everyone can afford the additional cost associated with food that is made in smaller quantities with higher-quality components. However, as consumers, we have the ability to influence the way Big Food does business by using our purchasing power. We can be cognizant of where we spend our money and make minor adjustments to our own buying habits.

image source: google