Byjus, once the most valuable edtech company in the world, is currently dealing with significant finance problems, a crisis in corporate governance, and legal disputes. The company will need to quickly fund at least $1.5 billion and clean house. Can it be a success?

In June, rumors about Byju’s delayed rent payment shook Bengaluru’s real estate community. Was the largest edtech company in India preparing to leave acres of offices? Think & Learn Pvt. Ltd., Byju’s corporate entity, had leased three sites, the largest of which was Kalyani Tech Park in Brookefield, which was spread out over 500,000 square feet and commanded a monthly rent of Rs 3 crore.

Byju’s left the majority of Brookefield at the end of July and instructed its employees to work remotely or at other locations. A leading property consultant executive revealed that Byju’s had been skimping on rents prior to the departure. He says, “I think it was coming.

Rent delays weren’t the first red flag. Byju’s had been relying on mandated benefits like the employee provident fund. According to PrivateCircle Research, a private market intelligence platform, it has decreased its headcount from 58,292 in March 2022 to 24,787 by May 2023.

Then the statutory auditor of Byju and three of the board members who represented its investors left. Russell Andrew Dreisenstock (Prosus NV), G.V. Ravishankar (of Peak XV Partners), and Vivian Wu (The Chan Zuckerberg Initiative) all left the board due to “differences” with the founder Byju Raveendran. Only Raveendran, his wife Divya Gokulnath, and his brother Riju Ravindran remained on the board.

The company’s auditor, Deloitte Haskins & Sells, stated that it was unclear when Byju’s planned to complete the 2021–22 accounts or even address the concerns it had with the 2020–21 accounts. Deloitte Haskins & Sells has a five-year mandate up to 2025.

The promoters were not responding to emails concerning its financial reports, according to multiple people close to the investors and the auditor who spoke to Business Today on condition of anonymity. According to one source, the promoters frequently assured the auditor and investors that “action is being taken” or that “we will return with a plan.”

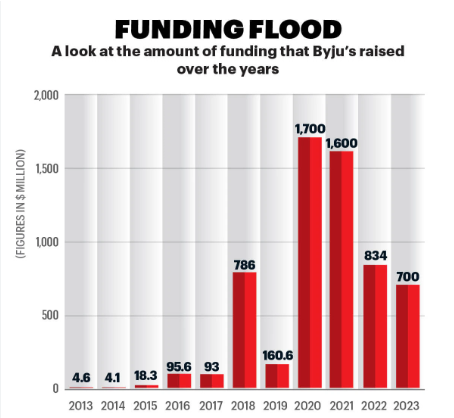

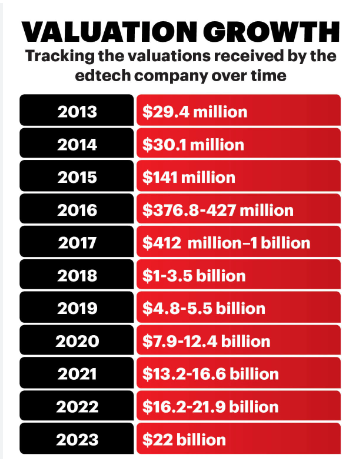

Cynics who contested Byjus $22 billion valuation (on which it raised the company’s previous two rounds of funding) now appear smug. The company’s plans to expand internationally are faltering, and its India business is doing poorly. It’s Byjus.

Byju’s, which took pride in its interactive teaching approach from kindergarten to Class 12, is mum on concerns raised by investors. A new funding infusion is necessary, but potential lenders are unlikely to write Byju’s a sizable check if they are unaware of the company’s performance throughout the previous fiscal year. (The corporation has not submitted the FY22 and FY23 audited financial reports.)

Ajay Goel was chosen by Byjus to serve as its first CFO in April 2023. Although it is not required by law for unlisted businesses like Byju’s to have a CFO, strong corporate governance does. A firm of the size of Byjus is quite rare in not having a CFO, especially when it raises large amounts of money and conducts expensive acquisitions.

“No one knows what the real numbers are, and that is not a comfortable situation for a potential investor,” claims Satish Meena, Principal Analyst at Datum Intel.

Even if Byju’s attracts a new bidder, the finance won’t be a simple equity offering but rather one that is highly complicated and priced below Byju’s peak valuation.

The edtech company, which has also incurred excessive debt, has lacked openness. An investment banker who asked to remain anonymous points out that Byjus must first utilize any new funds to reduce its debt. Who among investors would favor doing that? To expand the business, you want to invest money. The banker further inquires, “How will anyone possibly estimate the valuation of this company? “A mere $200-300 million doesn’t help; it has to be a large round, maybe about a billion,” the banker continues. “How are you going to pull together a contract worth a billion dollars? That sum of money is enormous.

Know more about byjus

Byjus Raveendran, Divya Gokulnath, and a group of students founded Think and Learn Pvt. Ltd. in 2011, which is where Byju’s app was created.Byju, a professional engineer, has been teaching math to students since 2006.Early on, the company concentrated on providing online video-based educational programs for the K–12 market and for competitive tests. The company first appeared in the Deloitte Technology Fast 500 Asia Pacific and Deloitte Technology Fast 50 India rankings in 2012, and it has continued to do so ever since. 2015 August.

image source: google