Contibution Margin: Many business leaders look at profit margin to determine how lucrative a company is. Profit margin is the total amount by which income from sales exceeds costs. However, if you want to know how a given product adds to the company’s profit, you need look at the contribution margin, which is the income left over after deducting the variable cost of delivering a product from the cost of creating it.

When running a business, it is obviously critical to understand how profitable the company is. Many business leaders consider profit margin, which is the total amount by which revenue from sales exceeds costs. However, if you want to know how a given product adds to the company’s earnings, you should look at the contribution margin.

To learn more about contribution margin, I spoke with Joe Knight, author of HBR Tools: Business Valuation and cofounder and owner of business-literacy.com, who says, “it’s a common financial analysis tool that’s not very well understood by managers.”

Also Read: DOMS IPO Allotment Declared: GMP, How To Check Status When The Emphasis Switches To The Listing Date

What Is Contribution Margin?

Knight cautions that it is “a term that can be interpreted and used in many ways,” but the traditional definition is as follows: When you create a product or supply a service and deduct the variable cost of delivering that product, the remaining revenue is the contribution margin.

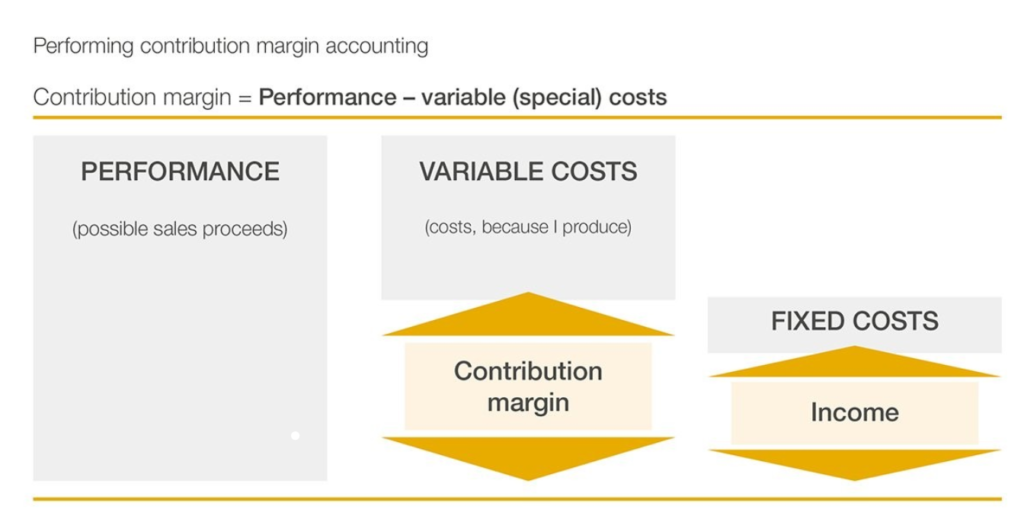

Knight argues that it’s a different way of looking at profit. Consider how most firm income statements work: Start with revenue, then remove cost of goods sold (COGS) to get gross profit, operating expenditures to get operating profit, and taxes, interest, and everything else to reach net profit. However, Knight adds that if you complete the calculation differently, removing the variable costs (more on that below), you will receive the contribution margin. “Contribution margin shows you the aggregate amount of revenue available after variable costs to cover fixed expenses and provide profit to the company,” according to Knight. Consider this the portion of sales that helps to cover fixed costs.

How do you figure it out?

It’s a simple calculation: Contribution margin = revenue − variable costs

For example, if your product costs $20 and the unit variable cost is $4, your unit contribution margin is $16. The first step in performing the computation is to reclassify all costs as fixed or variable on a standard income statement. This is not as simple as it appears because it is not always clear which costs belong to which group.

As a refresher, fixed costs are corporate expenses that stay constant regardless of how many products or services are produced—for example, rent and administrative wages. Variable costs are expenses that change depending on the quantity of product produced, such as direct materials or sales commissions. Variable costs are not the same as COGS, as some people believe. (When COGS are subtracted from sales, you obtain gross profit, which is not the same as contribution margin.) COGS, in fact, covers both variable and fixed costs. Knight cites a client who develops automation systems for airbag machines. Factory costs, electricity charges, production equipment, and labor are all included in COGS for this client, and all are fixed costs, not variable.

“Some parts of operating expenses, which we assume are fixed, are in fact variable,” he said. “The costs of running the IT, finance, and accounting groups are all fixed, but, for example, the sales force may be compensated with commissions, which would then be considered variable.”

Doing this calculation correctly is “a tremendous amount of work,” according to Knight, “and it is critical that you are consistent in your breakdown of fixed and variable costs over time,” but the knowledge gained by looking at profitability at the product level is frequently worth the effort.

How do companies use it?

Analyzing the contribution margin assists managers in making a variety of decisions, such as whether to add or remove a product line, how to price a product or service, and how to structure sales commissions. The most typical application is to compare products and decide which to keep and which to discard. If a product’s contribution margin is negative and the corporation is losing money with each unit produced, then the product should be discontinued or priced higher. If a product has a positive contribution margin, it is likely to be kept. This is true even if the product’s “conventionally calculated profit is negative,” according to Knight, because “if the product has a positive contribution margin, it contributes to fixed costs and profit.”

“Some companies spend a lot of time figuring out the contribution margin,” he said. It necessitates that a managerial accountant devote time to thoroughly separating fixed and variable costs. For companies like GE, there is a strong emphasis on viewing products “through a contribution margin lens.” This is significant for GE because the corporation is “a disciplined firm that works in very competitive industries and wants to cut out nonproductive products.” As a result, it prunes those with a low contribution margin.

A division head at GE is likely overseeing a portfolio of 70 or more products and must continuously reassess where to deploy resources. “As a division head, if I have to cut, I’m going to cut products that have the lowest contribution margin so that I can focus resources on growing the business and increasing profit,” Knight said.

Of course, GE has a large number of resources to devote to this analysis. But, according to Knight, this metric should be considered by all companies, not just the GEs of the world: “Every company should be looking at contribution margin.” It’s a critical perspective on profit, in part because it pushes you to grasp your company’s cost structure.”

What mistakes do people make?

There are “so many ways you can make a mistake,” according to Knight, all of which derive from the fact that “costs don’t fall neatly into fixed and variable buckets.” He cautions that some costs are “quasi-variable.” For example, you may temporarily enhance output by adding another machine to the production process. This falls between the two categories since it may be regarded as an additional expense owing to the increased production (and therefore variable), or it could be considered a fixed cost because it is a one-time purchase that does not vary with the amount of product produced. Certain salaries may also be viewed in this light at times.

“The financial analyst makes a distinction that requires a judgment call on where to classify these salaries,” Knight said. R&D spending is also scrutinized. “Some consider them fixed costs, while others consider them direct costs associated with the product.”Because of how these costs are classified, your contribution margin could be significantly different.”

Another mistake that some managers make is assuming that you should cut the items with the lowest contribution margins. However, you should not rely solely on contribution margin or any other measure of profit; you should also consider fixed cost allocation. Consider a company’s cash cows, a term coined by the Boston Consulting Group to characterize items that provide a consistent income or profit. In general, these items require very minimal support; you do not need to engage in sales or R&D. Despite this, cash cows typically have poor contribution margins since they can have significant variable costs while not drawing on the company’s fixed costs.

However, you might not want to cut them as a result; “you have to consider the cost of supporting a product” and “how much of the company’s fixed costs is associated with the product,” Knight says. “When you find that these low-contribution-margin products fill a product line or are a barrier to entry for a competitor, you should probably consider keeping the product around.” Looking at contribution margin in isolation will only provide you with so much information. You should consider other profit criteria before making any important business decisions.

Click here, to check out the latest post on Instagram.

Also read: BT500 Wealth Creators Summit: What Is Driving India’s Improved Corporate Governance Practices?

image source: google