According to Reuters, Haldirams is valued at about $10 billion, and Tata Consumer Products is seeking to acquire at least a 51% share in the company.

- SUMMERY

- Family-run snack manufacturing behemoth Haldiram’s has formally refuted reports that it is thinking about selling a 51% interest to the consumer division of Tata Group.

- The management of Haldiram has indicated that they are not in talks with Tata Group for a takeover.

- Tata Consumer Products also refuted news rumors that it was exploring purchasing a stake in Haldiram’s earlier in the day.

Haldiram , a family-run snack manufacturing behemoth, has formally refuted reports that it is thinking about selling a 51% interest to Tata Group’s consumer unit. According to Reuters, Tata Consumer Products is seeking to purchase at least a 51% share in Haldirams at a $10 billion valuation.

According to rumors, Haldiram had also been in discussions with Bain about selling a 10% stake in the business. For a 51% interest in Haldiram’s at this price, Tata Group would have spent more than Rs 40,000 crore.

Haldiram management statement

According to the management of Haldiram, there are no takeover talks going on between them and Tata Group. According to a business statement, “We categorically deny recent reports of a 51% stake sale and wish to clarify that we are not engaged in any discussions with Tata Consumer Products.” In India, Starbucks and Tata Consumer Products have a cooperation. Tata Consumer Products owns the UK tea firm Tetley. In the most recent fiscal year, Tata Consumer Products earned $1.7 billion in revenue.

Haldiram’s began operations in 1937 and is well known for both its sweets and savory foods. In recent years, it entered the Quick-Service Restaurant (QSR) market. About 150 restaurants operated by it’s serve regional cuisines, sweets, and western fare. Different generations of the Agarwal family are in charge of the company’s three main hubs, Haldiram Snacks in Delhi, it’s Foods International in Nagpur, and Haldiram Bhujiawala in Kolkata.

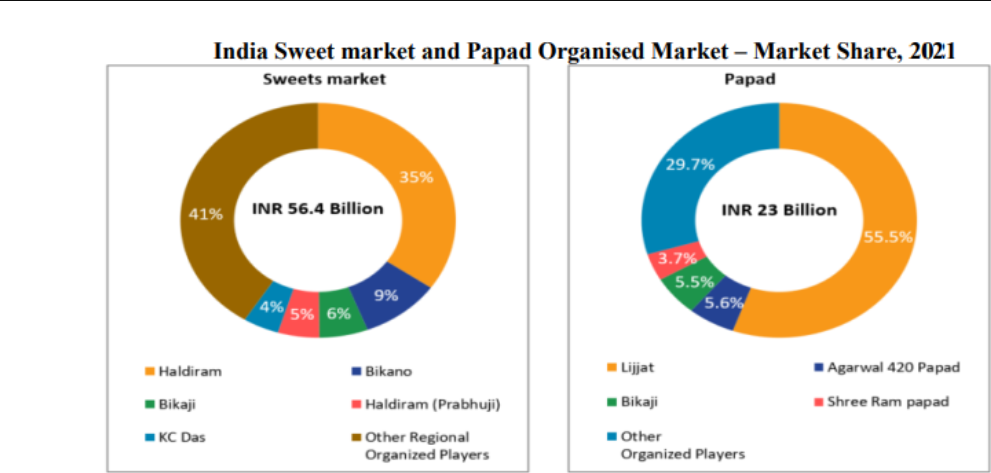

According to Euromonitor International, it has a market share of over 13% for snacks in India, which is nearly equal to Lay’s potato chips. The fiscal year that concluded in March 2022 saw at least $981 million in revenue for it. There are numerous registered businesses in the nation.

Manohar Lal Agrawal, the chairman of Haldiram, stated last year that the business hoped to draw in private equity investors and make its stock market debut in two to three years. The three brothers who own Haldiram’s in Delhi and Nagpur reportedly decided to combine their businesses in 2022 to form a single, sizable snack company.

According to those in the know, the merger is part of a strategy to submit paperwork for an initial public offering (IPO) in an effort to make a debut on Dalal Street within the next 18 months.

Tata Consumer Products had earlier in the day disputed news reports that it was in talks to acquire a share in this. The shares then fell 1.87 percent, to Rs 862.5, at 9.20 am. Following the release of the report on Wednesday, the stock increased by more than 4%. The shares decreased by about 2.5% to settle at Rs 858.40..

It should be mentioned that it, a family-run company established in a modest shop in 1937, is well known for their crispy “bhujia” snacks, which are inexpensive and frequently offered in mom-and-pop stores throughout India. It controls an estimated 13% of India’s $6.2 billion market for savory snacks, a market share that is comparable to Pepsi’s Lay’s chips.

In addition to being available domestically, it’s snacks are also sold in Singapore and the US markets. The business runs about 150 eateries that offer a variety of regional and western food as well as desserts.

also read: Understanding PB Fintech Share Price And Trends In 4 Points