Axis Bank and Kotak Bank: Kotak said banks recorded better-than-expected results, while IT services performed mediocrely, adding that consumer companies struggled for growth for another quarter.

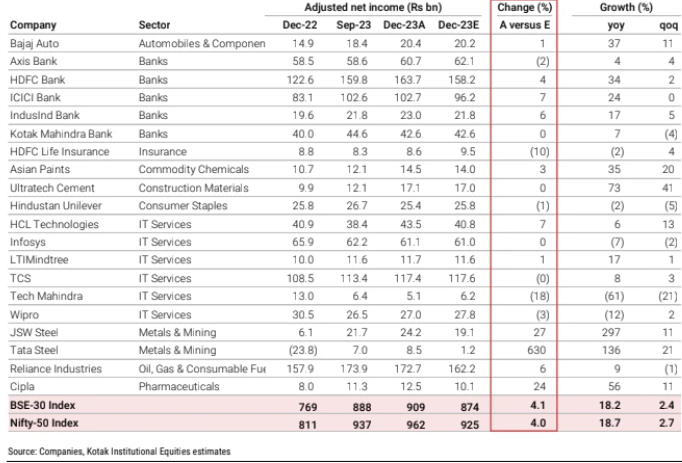

So far, Nifty companies announcing quarterly results, including HDCF Bank Ltd, ICICI Bank Ltd, Reliance Industries Ltd, Infosys Ltd, and Tata Consultancy Services Ltd, have reported an 18% increase in combined net profit year on year, which Kotak Institutional Equities says is 4% higher than expected. However, the brokerage felt the Q3 results contradicted both the numbers and the market story.

Banks outperformed expectations, while IT services performed mediocrely, according to the report. Consumer companies fought for growth for another quarter, while the residential real estate industry continues to expand.

“3QFY24 continued the trends of the previous quarters. They emphasised the disparity that has existed in the Indian economy for over a year. Consumption remains poor, emphasising the constraints faced by low-income households, while investment, particularly in high-end residential real estate, remains strong, emphasising the good financial position of high-income households,” it stated.

According to Kotak, while the Nifty Q3 results were somewhat ahead of expectations, the majority of the beat came from banks.

“However, banks’ multiples took a hit due to a ‘negative’ narrative (peaking-out theory) and incremental events (deposit problems, lower NIMs), despite a compression in NIMs during FY2024-25E being factored in statistics. IT services companies posted bad results in general (again), but the multiples reflect a ‘positive’ narrative (bottoming-out thesis) and incremental developments (recovery in sales), even after accounting for the revenue recovery,” Kotak added.

According to Kotak, negative spending patterns continued in the December quarter, and there is no quick remedy for consumption. We do not see a quick remedy for low-income household consumption without a strong and persistent rebound in employment and income. As stated in multiple publications in recent months, weak consumption reflects low income growth, with the majority of new jobs going to low-income workers. It stated that costs for popular products have grown significantly in the last 4-5 years.

“Other investment companies have yet to disclose; the interim budget is critical. We will get a better sense of the investment cycle’s sustainability in the coming days as (1) capital goods companies report earnings and provide guidance on near-term order inflows, and (2) the Indian government presents its interim budget on February 1 with guidance on government capex for FY2025E,” Kotak said.

Kotak forecasts a 15% increase in government capital expenditure for FY2025, with substantially higher estimates for the railway and road sectors. “The multiples of the investment stocks have rerated sharply in the past 1-2 years on the narrative of a strong cycle; these multiples would now need the backing of solid numbers,” according to the report.

Kotak said it will stick to sectors and stocks that are properly valued or moderately overvalued. The market either overestimates market size and profitability in several sectors (automobiles & components, capital goods, electric utilities) or underestimates ‘disruption’ risks in the same or other sectors.

Click here to check out the latest post on Instagram.

Also read: Unlocking Efficiency: Outsourcing Tasks To Freelancers And Contractors

image source: google