Car sales in the United States are likely to rise modestly next year as the automotive sector continues to recover from the coronavirus epidemic and other supply chain issues that have plagued it since 2020.

- IMPORTANT NOTES

- Sales of new vehicles in the United States are predicted to rise modestly next year as the sector recovers from the coronavirus epidemic and other supply chain issues that have plagued the industry since 2020.

- Auto sales are expected to climb by 1% to 4% next year, totaling 15.6 million to 16.1 million vehicles sold.

- The forecasted growth in the United States compared to a 2.8% year-over-year increase in worldwide auto sales predicted by S&P worldwide Mobility.

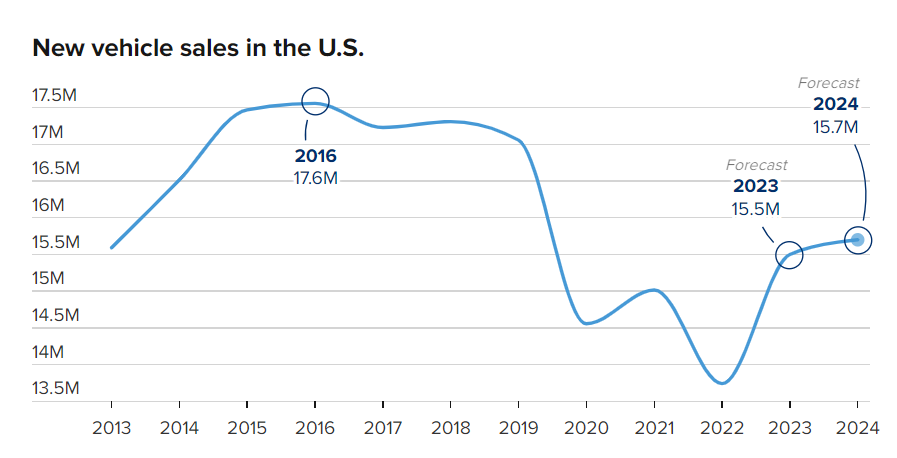

Leading automotive statistics businesses predict a year-over-year growth of 1% to 4% to around 15.6 million to 16.1 million vehicles sales. Such sales would be the most since 2019, when over 17 million new vehicles and trucks were sold in the United States.

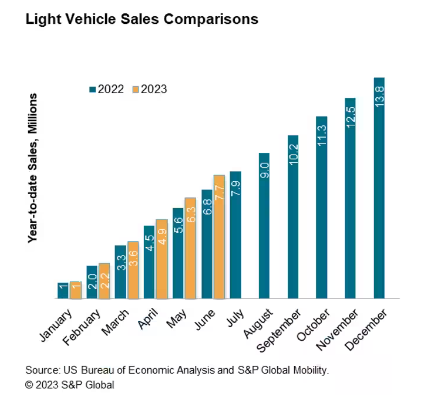

Since then, the car industry has been experiencing manufacturing and supply chain issues caused by the global Covid health crisis, with sales of less than 14 million vehicles in 2022 – the lowest in more than a decade – the lowest in more than a decade.

ALSO READ: 7 Passive Income Ideas To Make Money And Build Wealth In 2024

Even a minor boost in US sales might be beneficial to both consumers and the economy. It would imply that more vehicles are being manufactured, perhaps alleviating current affordability worries in the face of rising inflation, high interest rates, and record-high new vehicle costs.

“While the year ahead holds the promise of further increased inventory and enticing deals that consumers have eagerly awaited, 2023′s high interest rates are expected to linger, provoking conflicting market dynamics.” said Jessica Caldwell, the head of Edmunds’ insights department.

Pricing power yields to incentives

Edmunds says automakers’ new vehicle pricing power has peaked, as improved inventories has pushed incentives back into the market. Increased sales are wonderful for investors, but reduced pricing and greater incentives are projected to be a drag on many manufacturers and dealers that have created record profits in recent years.

“Automakers specifically will weigh one other key consideration in 2024: Are they satisfied with this newly established supply-demand equilibrium, or are they willing and able to push sales volumes closer to prepandemic norms?” Caldwell explained.

The forecasted growth in the United States is compared to a 2.8% year-over-year increase in worldwide auto sales predicted by S&P Worldwide Mobility. “2024 is expected to be another year of cagey recovery, with the auto industry moving beyond clear supply-side risks into a murkier macro-led demand environment,” said Colin Couchman, executive director of global light vehicle forecasting at S&P Global Mobility.

Any gain in US sales next year would be the car industry’s first sequential sales growth since 2015-16. S&P’s sales projection for the United States is among the highest. It anticipates sales of 15.9 million units in 2024, a 2% rise from predicted sales of 15.5 million units in 2023. GlobalData, which just purchased LMC Automotive, predicts a nearly 4% increase in new car sales in the United States to 16.1 million units.

According to Edmunds, 15.7 million new vehicles and trucks will be sold in 2024. This represents a 1% increase from the expected 15.5 million vehicle and truck sales in 2023. Cox Automotive predicts 15.6 million vehicle sales at the low end, primarily due to an increase in fleet or commercial sales. Retail sales will be “mostly flat,” according to Cox.

“Overall, we expect sales growth to be constrained and weak in 2024 – a bit more normal compared to the chaos of the last three years,” wrote Jonathan Smoke, chief economist at Cox Automotive, in a blog post. “As an economist, headline-making swings in economic trends are always interesting to see and analyze, but such turbulence is rarely good news for business over the longer term.”

Click here, to check out the latest post on Instagram.

Also read: Understanding The Difference: Cost Vs Price

image source: google