Interim Budget 2024: Suggestions have also poured in for a return to the Old Pension Scheme for government employees, as well as a review of the ration card scheme.

- Over 1,200 submissions were made to the government’s online budget ideas invitation.

- Some want higher taxes on pan masala, gutkha, and lower school fees.

- Some seek a cap on real estate prices and tax incentives for businesses to encourage work from home.

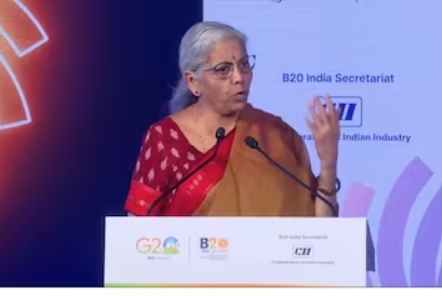

Lower taxes, more rebates for seniors, increased investment in healthcare and infrastructure, direct flights to Lakshadweep from state capitals, and a cap on real estate prices. These are some of the things on the wishlist of the ‘aam aadmi’ (common man) as they await Union Finance Minister Nirmala Sitharaman’s presentation of the Interim Budget 2024-25 on February 1. Citizens had made suggestions to the government as part of the Jan Bhagidari initiative. Every year, the government solicits suggestions from citizens prior to the creation of the budget.

“Your ideas can help to make the budgeting process more participative and inclusive. Share your innovative thoughts, strategic insights, and transformative ideas that will help India emerge as a global economic powerhouse. We eagerly await your contributions, recognizing the critical role you play in guiding our country’s economic trajectory,” the government stated on the MyGov website. In total, the portal received just over 1,200 submissions.

Given that this is an interim budget before the general elections, many of the proposals revolve around giving sops to the middle class to help them increase their spending capacity. Some of the suggestions include a review of the income tax brackets for salaried workers who are already required to pay taxes on their salaries. Some of the key requests include fiscal incentives for senior citizens, such as loans to renovate and paint their homes, expanded health insurance programs, and discounts on train tickets.

Suggestions have also poured in for reverting to the Old Pension Scheme for government employees, as well as a review of the ration card scheme to eliminate distinctions and provide free foodgrains to seniors over the age of 65. Another suggestion was to raise taxes on pan masala, gutkha, alcohol, and cigarettes. According to the respondents, this would not only reduce the risk of cancer but would also result in cleaner surroundings, in line with the Swachh Bharat Abhiyan.

Citizens have also requested government intervention to reduce school fees, thereby easing the financial burden on students, as well as increased funding for health and education to improve service quality. Others have sought to promote sustainable development by supporting innovation and technology, as well as focusing on skill development, digital literacy, and encouraging investments in renewable energy.

One of the out-of-the-box proposals is to cap real estate prices in order to make homes affordable to the middle class. Another proposal was to eliminate all direct taxes in favor of a single goods and services tax rate, as well as to provide tax incentives to companies that allow employees to work from home.

Frequently asked question

Will 80C limit increase in 2024?

Expectations include a higher deduction for housing loan principal repayment, which is currently limited to ₹150,000 under section 80C. The tax deduction limit for interest payments on self-occupied property should be increased from ₹2 lakhs to ₹3-4 lakhs.

What is an interim budget?

The interim budget provides financial details for the transitional period. With the Lok Sabha elections expected around April-May 2024, the new government will present a complete Budget in July 2024. On February 1, Sitharaman will present an interim budget for 2024-25 in Parliament, effective from April 1, 2024.

Click here to check out the latest post on Instagram.

Also read: Procter & Gamble Price Increases Increase Revenue, But A Write-Down Of Gillette Affects Earnings

image source: google