Jet Airways Share Price In -Depth Analysis: Get a glimpse into the future with our Jet Airways share price forecast for 2023.

In the ever-evolving world of finance, staying ahead of the curve is essential. If you’re considering investing in Jet Airways or are simply curious about the potential fluctuations in its share price for 2023, you’ve come to the right place. In this comprehensive article, we will delve into the factors that may influence Jet Airways’ share price in 2023 and provide you with a well-informed forecast.

Jet Airways Share Price : Introduction

Jet Airways Share Price : Jet Airways, once a formidable player in the aviation industry, faced turbulent times in recent years. However, with restructuring efforts and potential market changes on the horizon, 2023 holds promise for the airline. Here, we present a detailed examination of the factors that could impact Jet Airways’ share price in the coming year.

Resurgence of Jet Airways : Jet Airways Share Price

Jet Airways Share Price : The revival of Jet Airways began with the successful resolution of its insolvency proceedings in June 2021. Under the new ownership of the Jalan-Kalrock consortium, the airline has set ambitious plans to re-enter the Indian aviation market. The consortium has infused capital, restructured the airline’s debt, and outlined a comprehensive strategy to rejuvenate the brand.

Revival Efforts : Jet Airways Share Price

Jet Airways has been on a path to revival since its tumultuous grounding in 2019. The airline has undergone significant restructuring, with new investors and management taking the helm. This revitalization effort includes:

1. Financial Infusion

One of the key aspects of Jet Airways’ revival is the substantial financial infusion it has received. New investors have shown confidence in the airline’s potential, injecting capital to support its resurgence. This financial stability can positively influence the share price.

2. Fleet Expansion

To regain its competitive edge, Jet Airways has embarked on a fleet expansion plan. This move aims to enhance its market presence and revenue streams, which could contribute to a more favorable share price outlook.

Market Dynamics : Jet Airways Share Price

Understanding the broader market dynamics is crucial when forecasting share prices. In the case of Jet Airways, several factors come into play:

1. Demand for Air Travel

The aviation industry heavily relies on passenger demand. As global travel restrictions ease and people’s confidence in air travel returns, Jet Airways stands to benefit. A surge in demand could lead to higher revenue, potentially reflecting in the share price.

2. Fuel Prices

Jet fuel prices are a significant operational cost for airlines. Fluctuations in oil prices can impact profitability. A rise in oil prices may squeeze profit margins, while a decline could have the opposite effect.

Key Factors Impacting Jet Airways Share Price in 2023

- Market Sentiment: The sentiment in the aviation industry has improved significantly as travel restrictions related to the COVID-19 pandemic have eased. With a rising demand for air travel, Jet Airways is poised to benefit from renewed consumer confidence.

- Route Expansion: Jet Airways is expected to relaunch its operations with a well-planned route network. By connecting major Indian cities and international destinations, the airline aims to regain its market share and compete effectively.

- Fleet Modernization: The airline has plans to modernize its fleet with fuel-efficient aircraft, reducing operational costs and environmental impact. A modern fleet can also enhance passenger comfort and safety.

- Cost Management: Efficient cost management is crucial for the airline’s sustainability. Jet Airways has restructured its operations to optimize expenses and improve profitability.

- Competition: The Indian aviation sector is highly competitive, with established players like IndiGo and SpiceJet. Jet Airways will need to navigate this competition effectively to regain its foothold.

- Regulatory Environment: Government policies and regulations can have a significant impact on the aviation industry. Jet Airways will need to stay attuned to regulatory changes and adapt accordingly.

ALSO READ : Nalanda University In G20 2023: A Testament To India’s Intellectual Heritage

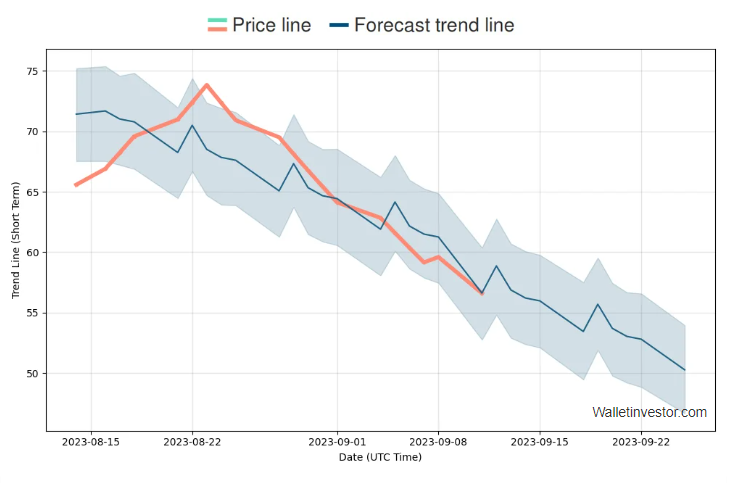

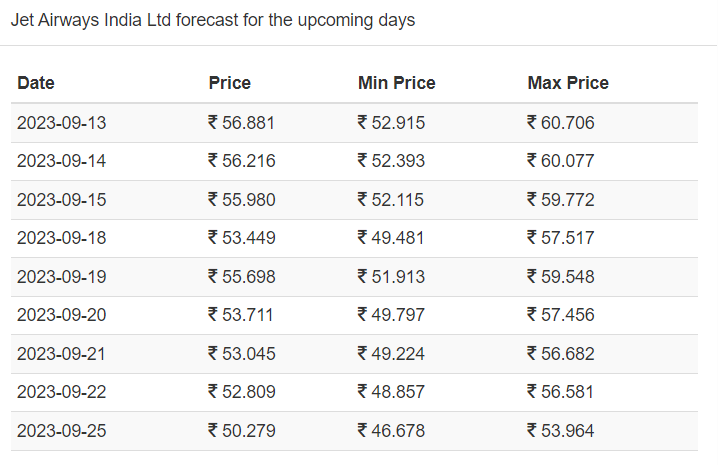

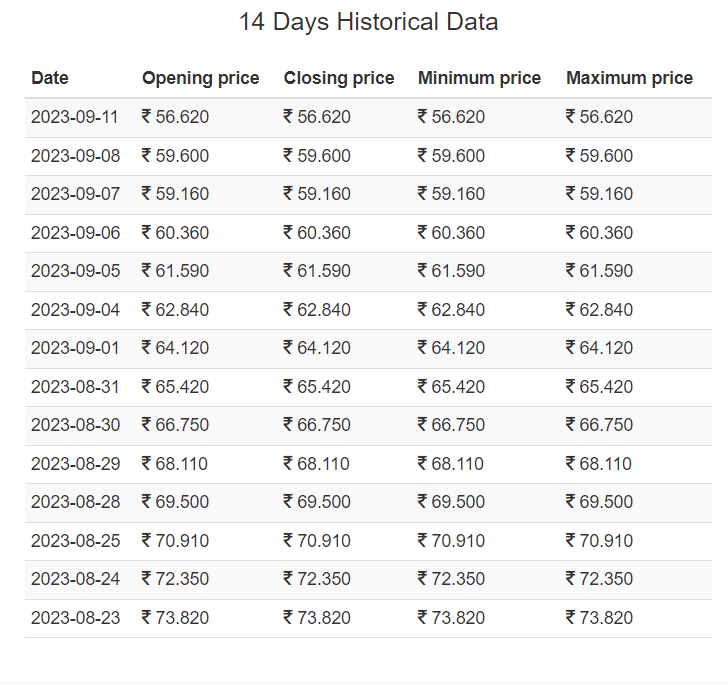

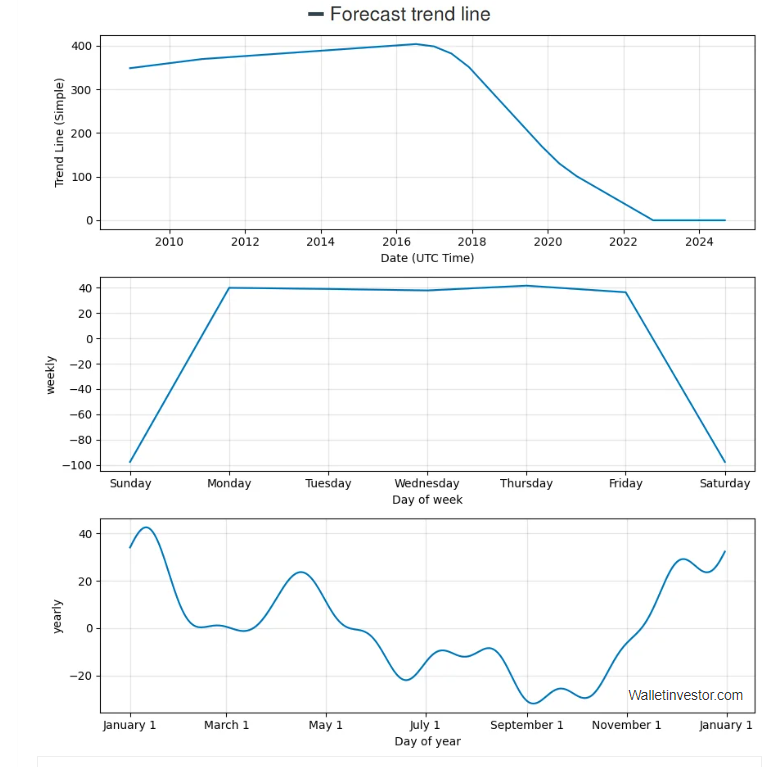

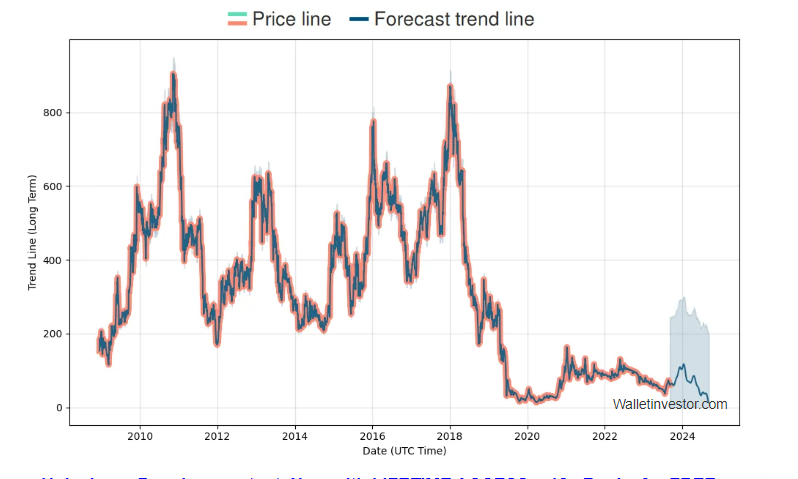

Jet Airways Share Price Forecast for 2023

Given the positive momentum and the steps taken by Jet Airways to revive its operations, many analysts are cautiously optimistic about its share price in 2023. While specific predictions vary, it is not unreasonable to expect a steady increase in the share price over the year.

While it’s challenging to make precise predictions about stock prices, several factors suggest a positive outlook for Jet Airways in 2023:

- Brand Value: Jet Airways remains a well-recognized brand in India. Its strong brand equity can attract loyal customers and drive demand.

- Strategic Investors: The Jalan-Kalrock consortium brings expertise and resources to support the airline’s revival, instilling confidence among investors.

- Economic Recovery: As the global economy continues to recover from the pandemic, the aviation sector is expected to rebound, benefiting Jet Airways.

- Pent-Up Demand: Many potential travelers postponed their plans during the pandemic. The release of pent-up demand for air travel can boost Jet Airways’ passenger numbers.

- Digital Transformation: Embracing digital technologies and e-commerce can help Jet Airways streamline operations, enhance customer experience, and capture online sales.

- International Expansion: Jet Airways’ plans for international routes can diversify revenue streams and open up growth opportunities.

It’s important to note that investing in stocks involves risks, and past performance is not indicative of future results. Potential investors should conduct thorough research and consult with financial experts before making investment decisions.

Competitive Landscape : Jet Airways Share Price

Jet Airways operates in a highly competitive industry. The actions of its competitors can influence its own share price. Key competitors include:

1. IndiGo

As one of India’s leading airlines, IndiGo’s performance can have a ripple effect on Jet Airways. Market share battles and pricing strategies are factors to watch.

2. SpiceJet

SpiceJet is another significant competitor. Their market moves and financial results can offer insights into Jet Airways’ prospects.

Regulatory Changes : Jet Airways Share Price

Regulatory changes within the aviation industry can have far-reaching consequences. Keeping an eye on government policies, safety regulations, and international agreements is essential when forecasting Jet Airways’ share price.

Conclusion of Jet Airways Share Price

In conclusion, predicting Jet Airways’ share price in 2023 is a complex task that involves analyzing various internal and external factors. The airline’s revival efforts, market dynamics, competitive landscape, and regulatory changes all play a vital role. While we cannot provide a precise figure, it is safe to say that Jet Airways’ share price is poised for potential growth in 2023.

As with any investment, it is crucial to conduct thorough research and consult with financial experts before making decisions. Keep a close watch on market developments, as they will provide valuable insights into the future of Jet Airways’ share price.

ALSO READ : A Panel Set By The Government To Study One Nation 1 Election To Lok Sabha And State Legislative Assemblies