- SOME POINTS

- As inflation slows, Kroger’s fiscal second-quarter sales estimates were missed.

- Because consumers are paying more for many of the things they purchase, inflation has helped grocery stores like Kroger generate greater total revenues.

- The grocery store, according to CFO Gary Millerchip, expects inflation to “continue to decelerate” and a harsher environment for customers in the months to come.

Consumer good news might turn out to be terrible news for Kroger. The store owner’s sales are declining as grocery prices remain stable or decrease.The business reported second-quarter fiscal revenues on Friday, but they fell short of Wall Street forecasts. The business maintained its full-year forecast but acknowledged that lower revenue would result from inflation slowing down.

Here’s how the grocer did in the three-month period that ended Aug. 12 compared with what Wall Street was anticipating, based on a survey of analysts by LSEG, formerly known as Refinitiv:

- Earnings per share: adjusted 96 cents vs. anticipated 91 cents

- Revenue: $33.85 billion vs the anticipated $34.13 billion

In comparison to a profit of $731 million, or $1 per share, in the same time last year, the firm reported a net loss of $180 million, or 25 cents per share. The company’s settlement of most of the accusations that it caused the opioid crisis was one of the contributing factors. To resolve the bulk of allegations that it caused the outbreak, the firm consented to pay $1.2 billion to American states, local governments, and Native American tribes. It recorded a $1.4 billion charge for that settlement during the quarter, which works out to a $1.54 loss per share.

From $34.64 billion in the same time last year, net sales decreased. Inflation has been uneven for retailers. On the one hand, because consumers are paying more for many of the things they purchase, it has helped to increase total sales. However, it has reduced the amount of goods sold since consumers hesitate to make purchases, particularly when adding luxuries to their shopping carts. Customers visit their big-box stores to buy food and necessities, but less so for other items, according to Target and Walmart in particular.

Due to the dominance of everyday products like food on the shelf, the slowdown in discretionary stuff has been less of an issue for Kroger outlets. However, it has increased the possibility that people may shop at stores like Walmart, Aldi, or Dollar General, which are recognized for having cheaper food costs. Along with its eponymous shops, Kroger consists of over two dozen grocery store companies, such as Fred Meyer, Ralphs, and King Soopers.

Home Depot has likewise observed the peculiar dynamic when inflation slows. Lumber prices have decreased since they spiked in price roughly two years ago, making its overall sales appear smaller. However, it has also been negatively impacted by customers purchasing fewer expensive products like appliances as a result of having to pay more for necessities.

According to StreetAccount, Kroger’s same sales excluding gasoline increased by 1% in the second quarter of its fiscal year, which was less than the 1.2% increase predicted by analysts. Factors like shop openings and closures are excluded from the industry measure.

In a statement reiterating its full-year forecast, Kroger stated that it anticipates same sales excluding gasoline to be in the 1% to 2% range. That includes the effects of terminating a contract with pharmaceutical benefit manager Express Scripts. According to the report, adjusted net earnings, which include the advantages of having an additional week in the year, are anticipated to fall between $4.45 and $4.60 per share.

The firm anticipates similar sales to be at the low end of its yearly range and slightly negative in the second half of the year when excluding gasoline, according to Chief Financial Officer Gary Millerchip, even though Kroger did not alter its projection.

He stated in an earnings announcement that the grocery store anticipates inflation to “continue to decelerate” and anticipates a more challenging environment for consumers in the months to come. According to consumer price index statistics from the U.S. Bureau of Labor Statistics, prices people spend for food they prepare at home aren’t increasing as quickly as they once did, but they are still up 3.6% from a year earlier in July.

Food costs at home are much higher now than they were before the epidemic, with a 25% increase from January 2019 to July of this year. According to Rodney McMullen, CEO of Kroger, a slower rate of inflation might boost sales in another manner. The grocery store is “starting to see some volume improvement,” he claimed, as inflation decreases. Additionally, he claimed that in order to maintain their revenues, manufacturers of consumer packaged products have been more open to negotiating prices with Kroger.

Kroger had significant growth in its digital sales throughout the quarter, which increased 12% year over year. It has constructed enormous warehouses to handle internet sales, which has allowed it to grow into other regions, like Florida.

Kroger has joined the list of merchants who blame organized retail crime for harming their sales.

On the company’s results call, Millerchip stated that the rise in shrink in the quarter was due to theft, the industry term for things lost due to breakage, theft, or other circumstances. In an effort to combat crime, he said that Kroger has increased security and introduced new technology. However, he noted that Kroger anticipates that the theft patterns “will continue to be a challenge for the remainder of the year.”

The business is working to finalize an agreement to pay $24.6 billion to acquire Albertsons, a competitor in the supermarket industry. Kroger revealed the most recent action taken to close the purchase on Friday. It claimed that the merged businesses had reached an agreement to sell more than 400 shops and eight distribution facilities to C&S Wholesale Grocers, a business that runs Grand Union and Piggly Wiggly supermarkets.

According to McMullen, the roughly $1.9 billion agreement will keep the business on course to complete the merger with Albertsons early in the next year. Antitrust regulators in Washington, D.C. are also investigating the grocery deal.

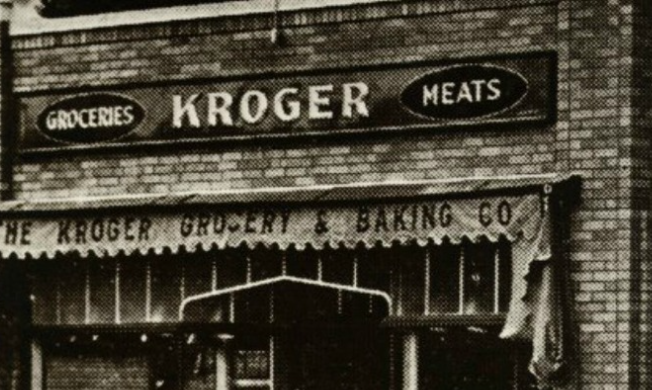

The History of Kroger

Bernard Kroger founded the company in Cincinnati, Ohio, in 1883, and it has a long and colorful history. It began as a single store and has now expanded to thousands of sites across the country, making it one of the biggest retail chains in the country. This expansion is evidence of Kroger’s dedication to offering high-quality goods and first-rate customer support.

also read: Most First-Time Homebuyers Don’t Put Down 20%

image source:google