- SOME POINTS

- The 20% down payment’s origins can be traced to the Great Depression for First-Time Homebuyers, and the figure continues to frighten people today.

- nearly 40% of Americans who don’t own a home cite a lack of down payment savings as their excuse.

- Realistically, though, “the typical first-time buyer has a down payment well under 20%,” according to Jessica Lautz of the National Association of Realtors. More frequently, folks only need to come up with 6% or 7%, according to Lautz.

People probably think of saving up a sizable sum of money for a down payment as soon as they consider one day purchasing a home. However, you may not require as much cash as you believe.

The concept of a 20% down payment as the norm stems back to the Great Depression, when mortgages were frequently for shorter periods of time than the 30-year term that is now the norm (and down payments were frequently much greater than one-fifth of the purchase price). Many government-backed mortgages required a 20% down payment in the ensuing decades.

At current pricing, that is a hefty sum. The median cost of a home in the United States First-Time Homebuyers is about $400,000. According to the 20% guideline, you would require $80,000.

nearly 40% of Americans who don’t own a home cite not having enough money saved for a down payment as their excuse. (For the report, a total of more than 4,300 adults in the U.S. were polled in late August.)

In actuality, though, “the typical First-Time Homebuyers has a down payment well under 20%,” according to Jessica Lautz, vice president of research and deputy chief economist at the National Association of Realtors.

Lautz claimed that the typical down payment for a first home is just 6% or 7% First-Time Homebuyers. According to ATTOM, the typical down payment for a single-family home was 7.5% of the median price during the first quarter of 2023.

In such situation, you would require about $24,000 for a home with a median price in the United States.

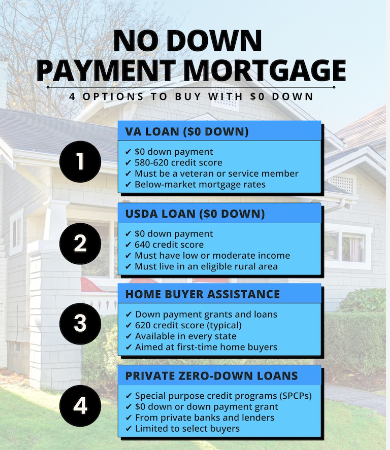

Even better, there are programs that would enable many prospective homeowners to put down even less money.

For first-time homebuyers, some mortgages require little to no down payment

According to experts, programs are available from the federal government, states, banks, and credit unions with less onerous down payments than the 20% mark.

Some federally funded programs let you purchase a home with no down payment or a very small one. Programs with low down payments are offered by the U.S. Department of Agriculture, the Federal Housing Administration, and the Department of Veteran Affairs, among others.

Meanwhile, lower options are also offered by financial intuitions. U.S. Bank promotes a 3% minimum down payment. In Arizona, Zillow has introduced a 1% down payment option for qualified buyers, with Zillow Home Loans contributing an additional 2%.

Remember that if you can only come up with a down payment of less than 20%, you’ll probably have to pay mortgage insurance because the lender will view it as riskier. According to Freddie Mac, this normally costs between $30 and $70 per month for every $100,000 borrowed.

First-Time Homebuyers grants assist with some expenses

According to Daniel Brennan, director of MaineHousing, “homeownership is still the best option for building equity over the long term” despite rising home prices and interest rates.

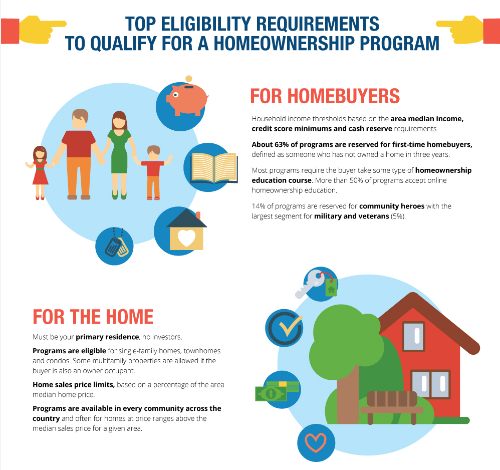

Programs run by some governments for First-Time Homebuyers, localities, and other organizations provide grants to homebuyers to boost their down payment or pay closing fees.

The First Home program for First-Time Homebuyers of the Maine Housing Authority offers qualifying homebuyers subsidies ranging from $5,000 to $10,000 for a down payment and closing costs. People who receive the cash are required to complete homeownership and financial literacy training.

Additionally, DC Open Doors in Washington, D.C., provides help with the down payment. Additionally, the Home First program in New York offers qualified residents up to $100,000 toward a down payment or closing costs.

Wendi Redfern, senior vice president of single family programs at DC Housing Finance Agency, said, “First-time homebuyers should know there are tools available.

According to Lautz, people can search for regional down payment help programs on Hud.gov. The website Down Payment Resource also connects borrowers with available solutions.

image source: google