Netflix earnings preview: Some experts ‘scale back’ their predictions for revenue growth.

- Results for Netflix’s third quarter of 2023 will be released on Wednesday following the end of the stock market.

- The business has put in place a rule that forbids sharing accounts with people outside of the family.

- Will the earnings reflect that, creating a buying opportunity after the stock correction?

The emergence of streaming platforms has significantly changed the global entertainment landscape, substantially displacing conventional media like television. Netflix (NASDAQ:NFLX), which offers people access to a sizable collection of films and television shows for a reasonable monthly cost, is at the forefront of this digital transformation.

A crucial event in light of the platform’s recent policy change on password sharing, expectations for the release of Netflix’s third-quarter earnings are rising as Wednesday draws near. This modification, which was made in May of this year with the intention of reducing unlawful account sharing, appears to be working because user numbers are rising. The shift will be apparent in the upcoming third-quarter statistics.

Intriguingly, however, despite Netflix’s strong user growth, its stock has been going through a significant correction phase, leading to suspicion that the end of this adjustment may produce outcomes that are better than current projections.

All eyes are on Netflix’s predicted earnings per share, which are now estimated at $3.48 along with revenues reaching $8.53 billion, as we approach the results. Notably, the prediction has seen a remarkable 24 revisions to the upside compared to just 3 revisions to the downside, demonstrating a high level of market expectation.

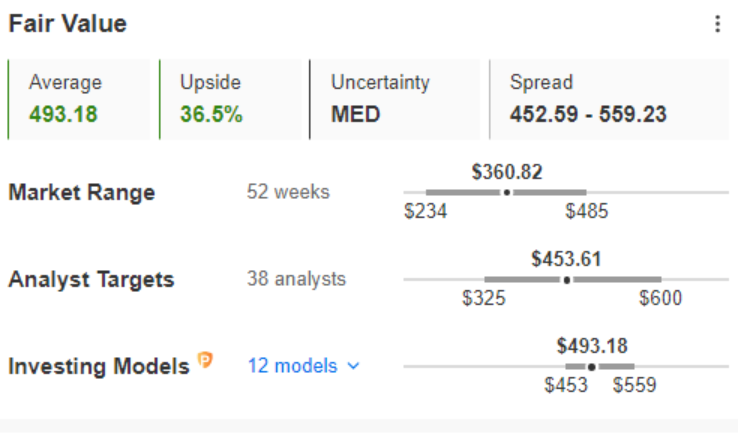

It should be observed that since October of last year, earnings per share have been clearly trending upward, which has coincided with the share price increasing to almost $485 at its highest in July. The fair value upside potential is still at just over 36%, which suggests that this year’s breakout to new highs is still a possibility.

Although a substantial demand impulse that would produce an upward technical formation is lacking from the chart, it might not occur until Thursday.

Also Read: As Wealth Management Results Disappoint, Morgan Stanley Shares Decline By 5%

New User Growth is About to Speed Up tends increase in Netflix Earnings

In May, Netflix made a crucial decision to implement new account-sharing regulations, which sparked intense public interest in how these changes would impact the trend of new user growth. The first few months convincingly supported this choice, and the second quarter saw a significant uptick of 5.9 million new subscribers, more than twice the earlier projections.

Unsurprisingly, this substantial inflow greatly increased income on a global level. Greg Peters, one of Netflix’s executives, struck an upbeat note by emphasizing the potential of this upward trend continuing for several more quarters.

Click here to explore Netflix.

It’s important to remember that sharing accounts with people outside of a single household is still possible, albeit at an extra fee of $7.99 per month in the US. In the meantime, conversations about prospective pricing changes for the ad-free bundle in the near future are picking up steam.

Technical Analysis: Is the Stock of Netflix Correcting at a Time to Buy?

In line with a wider downturn in the US stock market, Netflix’s stock prices started to decline around the middle of July. The local support level, which is located in the price range about $350 per share, is now being approached by the selling pressure. There hasn’t yet been a clear market reaction, and any future movement may depend on the release of third-quarter data, which won’t happen until after Wednesday’s session.

Buyers’ main goal as the rebound scenario takes shape will be to surpass the crucial $400 per share mark, potentially opening the door for another assessment of the region around $480. However, there is a chance of a decline into the $300 zone if purchasers are unable to retain the tested support, assuming there is major disappointment in the released data. However, at this time, this conclusion seems less likely.

Disclaimer: Note that none of these shares are owned by the author. This information is provided for informational purposes only and should not be construed as investment advice.

image source: google