Explore the PB Fintech share price and its significance in the financial world. Gain insights into its trends and performance.

In the dynamic realm of finance, where trends shift like the sands of time, one name has been consistently making waves – PB Fintech. This article delves into the intricate world of PB Fintech’s share price, unraveling its significance in the financial landscape, and providing valuable insights into its trends and performance.

also read: Understanding Better Life Insurance Policies

Introduction

PB Fintech, a formidable player in the financial industry, has captured the attention of investors and enthusiasts alike. The intriguing rise and fall of its share price have been a topic of extensive discussion and analysis in the financial world. In this article, we embark on a journey to decipher the mysteries behind PB Fintech’s share price movements, shedding light on its implications for both seasoned investors and newcomers to the financial sphere.

The Unraveling Trends

A Historical Perspective

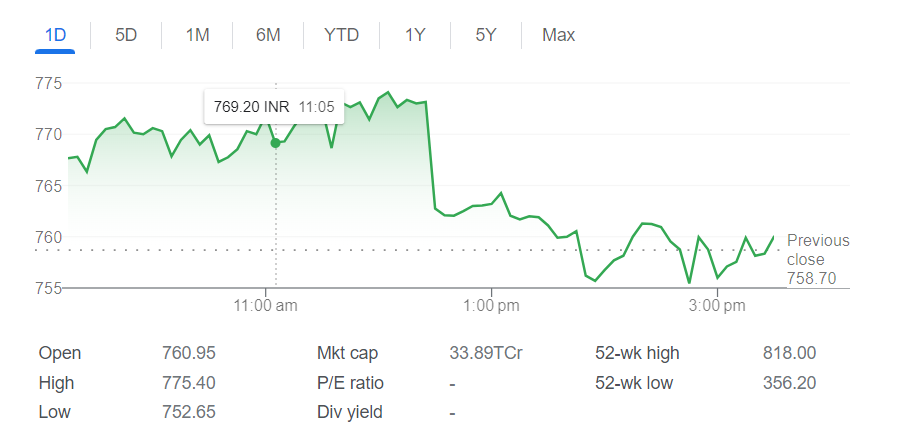

To comprehend the significance of PB Fintech’s share price, it’s essential to start with a historical perspective. PB Fintech has undergone a remarkable journey since its inception. From humble beginnings to its current stature, tracking its share price over the years provides valuable insights into its growth trajectory.

Market Volatility and PB Fintech

Market volatility has been a defining factor in the fluctuation of PB Fintech share price. The financial world is no stranger to abrupt shifts in market sentiment, which can cause substantial fluctuations in stock prices. Understanding how PB Fintech navigates these turbulent waters is crucial for any investor looking to capitalize on its potential.

Industry Trends and PB Fintech’s Position

PB Fintech operates in a dynamic industry that is constantly evolving. Staying abreast of industry trends and innovations is paramount to understanding the factors influencing its share price. We explore how PB Fintech positions itself within the industry and adapts to emerging trends.

Performance Analysis

Financial Metrics

Examining PB Fintech’s financial metrics is essential to gauge its overall performance. Key indicators such as revenue growth, profit margins, and debt-to-equity ratios offer valuable insights into the company’s financial health. We delve into these metrics to assess PB Fintech’s stability and growth potential.

Competitive Landscape

In the fiercely competitive financial sector, PB Fintech faces rivalry from both established players and innovative startups. Analyzing its competitive position and strategies for gaining market share provides valuable context for interpreting its share price movements.

Investment Considerations

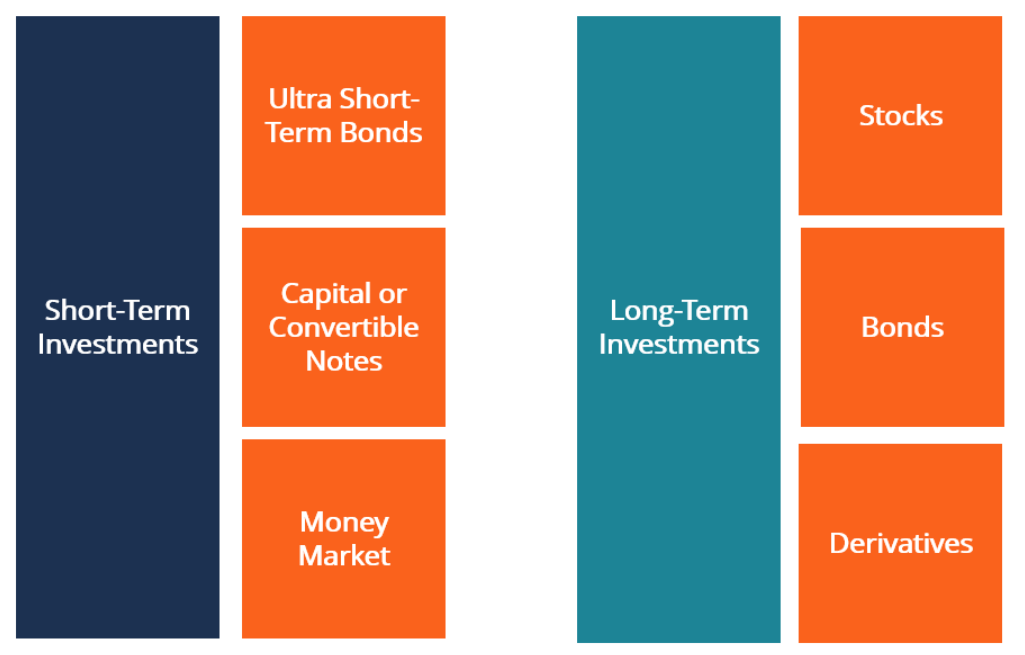

Long-term vs. Short-term Investment

Investors often grapple with the decision of whether to take a long-term or short-term approach when investing in PB Fintech. We provide an in-depth analysis of the pros and cons of each strategy, helping readers make informed investment decisions.

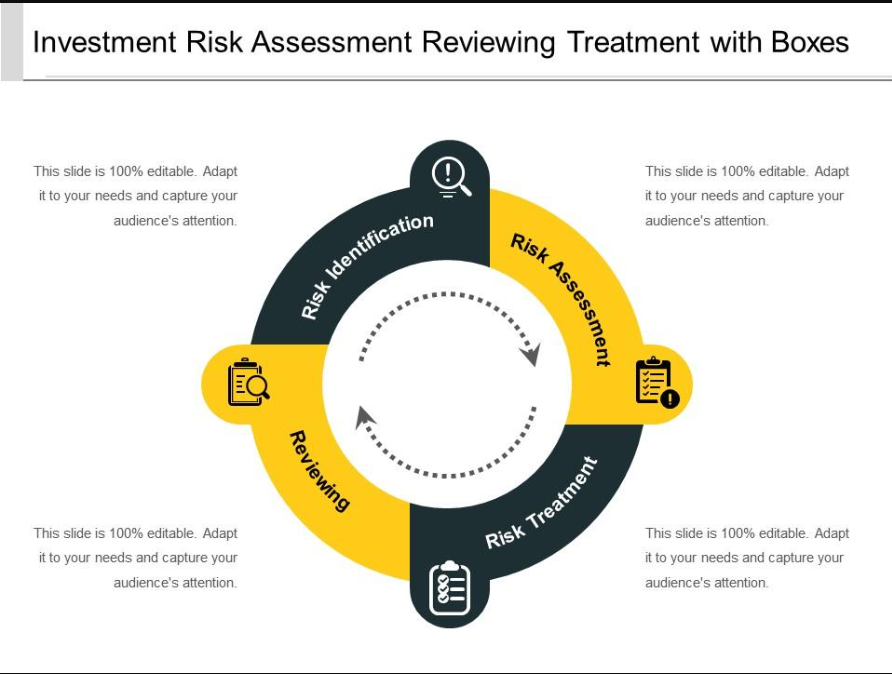

Risk Assessment

No investment is without risk, and PB Fintech is no exception. We evaluate the potential risks associated with investing in PB Fintech and offer strategies for risk mitigation. Understanding these risks is vital for prudent investment planning.

Trends in PB Fintech Share Price:

Tracking the historical trends of PB Fintech’s share price can provide valuable insights into its journey as a fintech company. Investors and analysts closely monitor these trends to make informed decisions. Here’s a breakdown of what various share price movements may signify:

- Upward Trends: A consistent increase in PB Fintech share price could signal strong financial performance, rapid growth, and positive market sentiment. It may also suggest that investors anticipate future success and are willing to pay more for a stake in the company.

- Downward Trends: Declines in PB fintech share price can indicate challenges or setbacks. These may be due to poor financial results, regulatory hurdles, or changes in the competitive landscape. A sustained decrease may prompt investors to reevaluate their positions.

- Volatility: Fintech companies, like PB Fintech, often experience greater price volatility than established financial institutions due to their innovative nature. Frequent fluctuations in pb fintech share price may be a characteristic of the fintech sector and should be interpreted with caution.

- Plateaus: Periods of relatively stable share prices may indicate a period of consolidation or market indecision. Investors might be waiting for more clarity on the company’s future direction or external factors that could impact its performance.

Conclusion

In conclusion, PB Fintech share price is a multifaceted phenomenon that holds immense significance in the financial world. Its historical trends, market dynamics, and performance metrics all play a pivotal role in shaping its value. As investors and financial enthusiasts, gaining a deep understanding of PB Fintech share price movements is crucial for making informed decisions.

image source: google