Retailers lose $100 billion yearly due to violations of policies including return fraud and coupon stacking, according to research from anti-fraud firm Riskified, which surveyed 300 global organizations.

- ESSENTIAL POINTS

- In one instance, just 4,000 people made 137,000 fictitious accounts to use a discount coupon, causing $14 million in losses annually.

- Because their returns process is so time-consuming and expensive, one survey respondent said they would rather to have a client break into their warehouse and steal an item than have them order it and return it.

In order to take advantage of a Black Friday Hulu special that most recently gave new customers a yearlong membership for just $1.99 per month rather than the customary $7.99 per month, Robert has been engaging in return fraud for the past three years.The social media manager has obtained numerous first-time client discounts on sports betting websites and while purchasing Manga, a type of Japanese comics, using identical strategies.

“I don’t really feel sympathy for a big corporation. Robert, a 31-year-old from Long Island, New York, who requested to only be known by his first name in order to protect his privacy, said: “I genuinely just don’t care.” It’s simple to do it online because all you’re doing is just setting up a new account or email address, and since there’s really no accountability, why not do it? he stated.

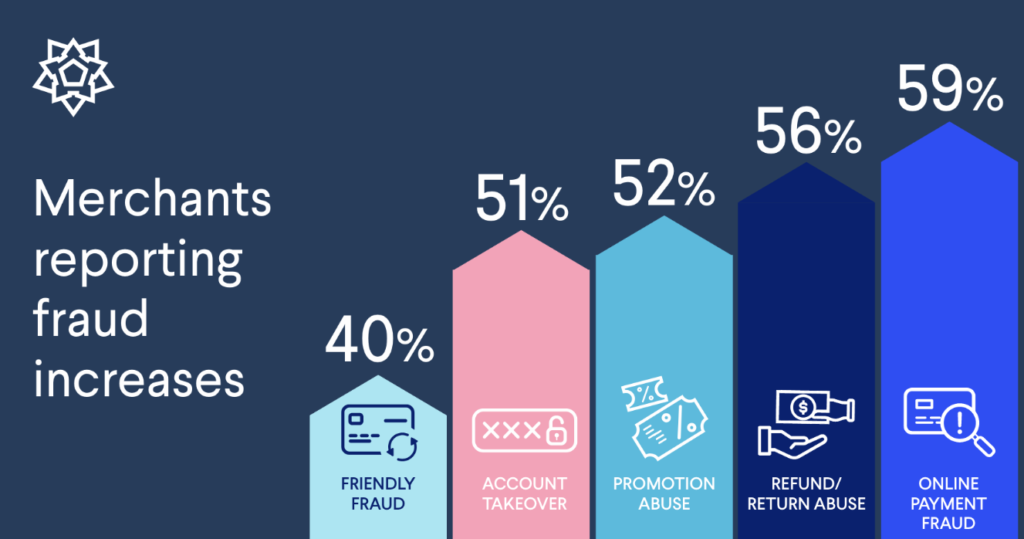

This kind of “friendly fraud” may look innocent and like a trivial matter to large organizations. However, when combined with other more egregious types of fraud, it costs merchants more than The company discovered a rise in some shops’ violations of retail policy, including return fraud and the use of fictitious email addresses for promotional offers. When there is a lot of inflation or around the holidays, the practices tend to increase.

Offering liberal refunds, return policies, and incentives to boost sales and boost customer loyalty are significant to the overall business strategy of about 90% of the organizations surveyed for Riskified’s report. While retailers try to safeguard their margins while they deal with high expenses, rising shrink, and a downturn in discretionary spending, the misuse of such programs is proving to be a significant drain on profitability, leading some to reconsider granting such freebies.

$100 billion annually, claims Riskified, which on Thursday released a fresh analysis of the issue.

At well-known shops like Wayfair, Peloton, Revolve, and Canada Goose, Riskified combines automation and artificial intelligence to combat fraud and increase sales. Over 300 international businesses with a combined yearly revenue of more than $500 million were polled for the study.

According to Riskified CEO Eido Gal’s observations“In our experience with merchants over the past two years, especially as they’ve been sharpening their pencils around profitability, they’ve really started to take a harder look at this,”

“When you think about how easy it is to call in and say I never received my item, I received the wrong item, or I want a different size, you can get a refund or a new item incredibly easily,” Gal added. “I think fraudsters have caught on to that because it’s much simpler to do that than it is to steal financial or credit card information.”

The range of abuse

Friendly fraud is sometimes viewed as a necessary evil that retailers must deal with as part of client acquisition.

It includes actions like purchasing many products with the goal of returning the majority of them, using multiple email addresses to take advantage of deals more than once, or wearing something with the intention of returning it and without having to pay for it.

However, the study found that frequent and professional fraudsters are abusing those loose standards and going further.

In one instance looked at by Riskified, a business discovered 137,000 fraudulent accounts made by just 4,000 unruly users hoping to benefit from a harsh 35% off promotion for new clients. The annual expense to the business exceeded $14 million.

In another instance, a tiny gang of serial fraudsters used a promotion code for a 35% to 50% off discount to steal $3.5 million from a leading U.S. pet supply company in just the first quarter of 2023.

In other instances, con artists pretend to have never received an order when in reality they did so they may get a refund and the goods for free.

In comparison to other forms of abuse, the majority of respondents, 55%, claimed their costs from those kinds of techniques were “very significant” in 2022, indicating that it has gotten more widespread and expensive.

“Merchants lack the time and resources to investigate claims. In fact, the survey found that investigating each claim individually might end up costing companies more money than simply accepting the customer’s claims. “Companies that ship goods to customers worldwide may not have visibility into the identities of their last-mile delivery partners, making it impossible for them to definitively rule out claims.”

Other criminal rules violations include returning empty parcels for a refund or using bots to purchase expensive, limited-edition items with the intention of reselling them for more money on a different platform. The tactic was used during the Eras Tour ticket sales for Taylor Swift, which are typical for limited-edition sneaker releases and live performances.

What are retailers doing about Return Fraud?

65 percent of those who responded to the poll reported that at least the majority of their refund and return claims are subject to manual reviews. The procedure may be expensive, time-consuming, and unsuccessful.

According to the poll, “one respondent even said they would rather have a customer break into their warehouse and steal an item than have them order and return it.” This was due to the lengthy and expensive returns process.

Gal, the CEO of Riskified, claimed that the “smartest” businesses are beginning to be more picky about whose customers should receive freebies and are utilizing customer records to figure out who should be required to pay for returns and who should send one in for nothing to avoid return fraud.

Gal stated, “Let me always offer free returns to my best customers because that’s the convenient thing to do and that’s what I want to do to be competitive, and let me work through and understand who’s not my best customer, and they would still have that restocking fee.”

ThredUp, an online retailer of previously worn clothing, has a specialized fraud and abuse task team that fights bad actors who misuse programs by using data and improved account monitoring, the business told.

As an illustration, the business recently debuted a tool called “Keep for Credit” that gives customers who want to return an item the choice of keeping the item(s) in exchange for store credit. It lowers the expense ThredUp incurs.

ALSO READ: UAW And Automakers Are Being Issued A Severe Warning By The Former CEO of Ford – 2023

image source:google