Sustained capex: Experts are keeping an eye on the agricultural sector, slower capex, and geopolitical developments.

- SUMMARY

- Lowering the nominal GDP growth estimate to 8.9% for FY24 may jeopardize the deficit target

- Tax collections are expected to continue strong.

- Private final consumption expenditures may be a source of concern.

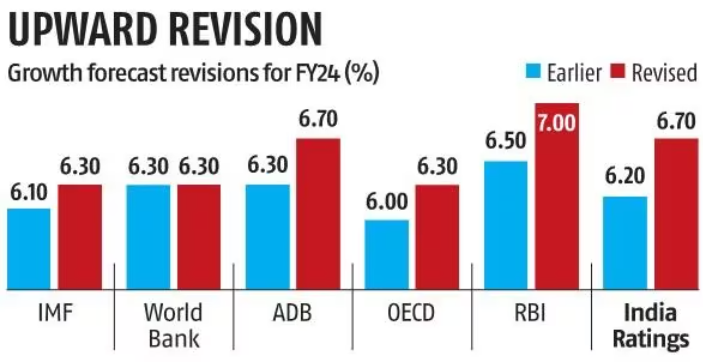

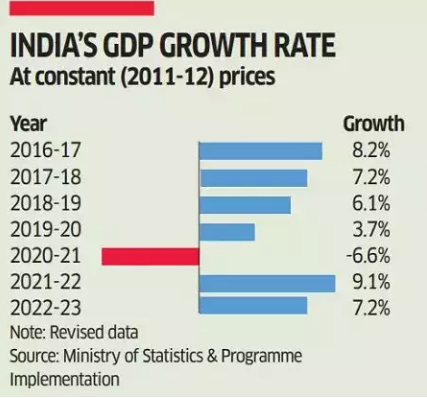

GDP is expected to expand by 7.3% in FY24, above expectations, thanks to the government’s continued capital expenditure and a resilient economy. The National Statistical Office’s first advance estimates of national income, issued on Friday, are significantly higher than the earlier expectation of 6.5%, which was later revised up to 7% by the Reserve Bank of India. The GDP growth projection is also marginally higher than the 7.2% growth seen in 2023–24, which might provide some relief to the government as it finalizes its projections for the Interim Budget.

The estimate is based on data extrapolations for the previous eight months. “Manufacturing and hotels will benefit from higher profits earned by companies this year, which are already visible in the first two quarters.” Mining and electricity growth are also visible in the monthly core sector data. This lends credence to the rapid growth concept. “Despite the high interest rate regime, the financial sector continues to perform well at 8.9%, as both deposits and credit have grown smartly this year,” said Madan Sabnavis, chief economist at Bank of Baroda, while noting that farm sector growth was disappointing.

ALSO READ: NCAA And ESPN Ink 8-Year, $920 Million Media Rights Deal

“The gross fixed capital formation rate has improved to 29.8% from 29.2%, which can be more driven by the government capex,” he further said.

However, concerns remain about the impact of lower-than-expected nominal GDP growth, which is now predicted at 8.9% in the current fiscal year, significantly below the budgeted 10.5% and 16.1% in 2022–23. According to analysts, this is largely attributable to the slowing of wholesale price growth, which has entered the deflationary zone this year. Lower nominal GDP growth would have an impact on the fiscal deficit, which is now expected to be about 6% of GDP in FY24.

According to DK Srivastava, Chief Policy Advisor at EY India, tax revenue growth is often determined by a combination of tax buoyancy and nominal GDP growth. “The budgeted buoyancy of the Centre’s gross tax revenues was only 0.99, implying tax revenue growth of 8.8%, well below the 10.4% GTR growth.” However, based on statistics from the Comptroller General of Accounts, we predict a larger than budgeted growth in the Centre’s GTR due to significantly stronger direct tax buoyancy than was assumed in the Budget,” he said, adding that they expect the GoI to meet its fiscal deficit target for FY24.”

According to the data, agriculture’s gross value added is expected to increase by 7.3% in FY24, while manufacturing is expected to expand by 6.5% and mining by 8.1%. Construction is expected to increase at the fastest rate, at 10.7%, while financial, real estate, and professional services are expected to rise at 8.9% and utilities at 8.3% in the current fiscal year. Experts are keeping an eye on the rural economy and capex growth ahead of the general elections, and they are also keeping an eye on global geopolitical events.

“Despite global headwinds, the growth momentum seen in FY24 demonstrates the resilience of the Indian economy.” However, the road ahead will be difficult as long as private final consumption expenditure does not fully recover and becomes broad-based. The key here would be to keep an eye on wage growth, particularly among lower-income households, because that is what is critical for broadening the base of consumption demand,” said Sunil Kumar Sinha, Principal Economist and Senior Director, Public Finance, India Ratings and Research, and Paras Jasrai, Senior Analyst, India Ratings and Research.

On the demand side, private final consumption expenditure (PFCE), gross fixed capital formation (GFCF), and exports are forecast to expand at 4.4%, 10.3%, and 1.4% in FY24, respectively (FY23: 7.5%, 11.4%, and 13.6%), while government final consumption expenditure (GFCE) is forecast to grow at 4.1% (FY23: 0.1%). Aditi Nayar, Chief Economist and Head of Research and Outreach at ICRA, stated that the NSO implicitly expects GDP growth to decelerate to 7% in the second half of the fiscal year from 7.7% in the first half.

“Growth assumed for H2 FY2024 is quite high in our opinion, given the tepid outlook for agriculture amidst weak kharif output and ongoing lag in rabi sowing, as well as the feared temporary slowdown in capex ahead of the General Elections.” In reality, the GoI’s capex fell by 8.8% year on year between October and November 2023, after soaring by 43.1% in the first half of the fiscal year,” she said.

“Amid sluggish consumer spending, robust domestic demand, and strong growth in the manufacturing and services sectors, economic growth is largely supported by state spending on infrastructure projects.” “The revised growth demonstrates the Indian economy’s resilience and its continued status as the fastest-growing major economy,” stated Nish Bhatt, Founder and CEO of Millwood Kane International. However, the impact on global GDP and commerce, particularly through disruptions in the supply chain and the fragile geopolitical scenario, must be monitored, he added.

Click here to check out the latest post on Instagram.

Also read: Mastering Buyer Problem: Strategies For Effective Solutions

image source: google