US economy 2023: Though Americans’ top concern may be the status of the US economy, the macroenvironment had a reasonably positive year in 2023.

- Important Points

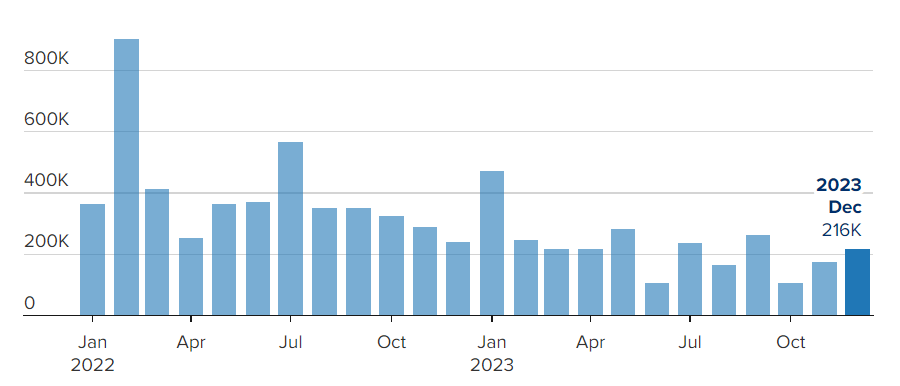

- When seasonally adjusted, the U.S. labor market produced about 2.7 million jobs in 2023 and more than 200,000 jobs in the final month of the year.

- The year-over-year growth in consumer expenditure was mostly driven by gains in travel and entertainment.

- However, there were several places where consumers faced difficulties due to high mortgage rates and low sales of older homes.

Markets saw significant gains, spending stayed high, and the Federal Reserve’s fight against inflation showed indications of cooling but not freezing. Then there is the employment market’s resiliency, which defies rationality almost entirely.

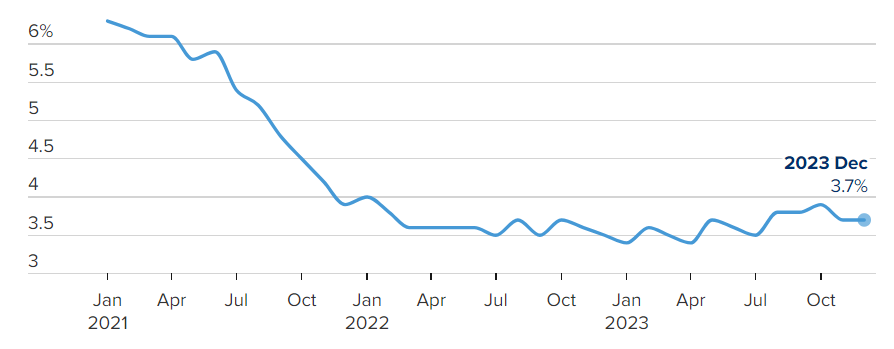

According to data issued on Friday by the U.S. Bureau of Labor Statistics, the labor market in the United States finished the year strong, adding over 200,000 jobs in December. The jobless rate stayed at a low 3.7%, and December was the 36th consecutive month that the U.S. economy created new jobs, despite earlier estimates for October and November having been revised down by a combined 75,000.

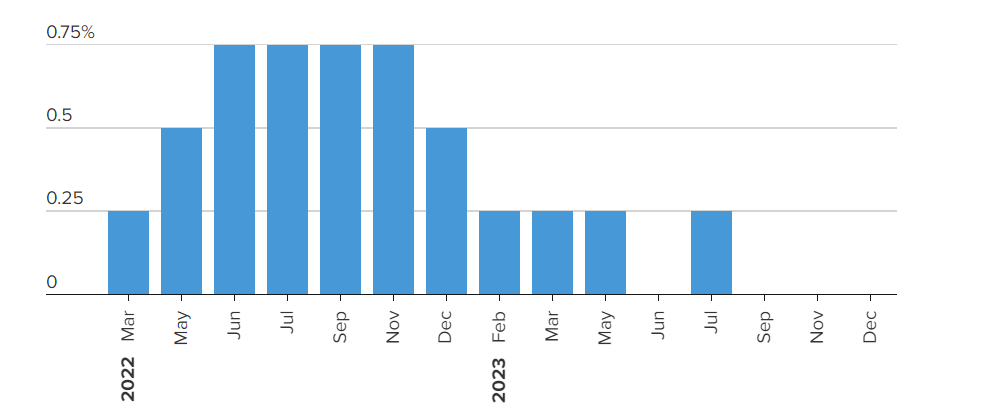

Monthly job creation in the U.S.

January 2022 through December 2023

U.S. unemployment rate

January 2021 through December 2023

Seasonally adjusted, the United States added around 2.7 million jobs overall in 2023. That number was released in spite of worries that the Federal Reserve’s continuous efforts to combat inflation by raising interest rates would cool the labor market and reduce consumer spending.

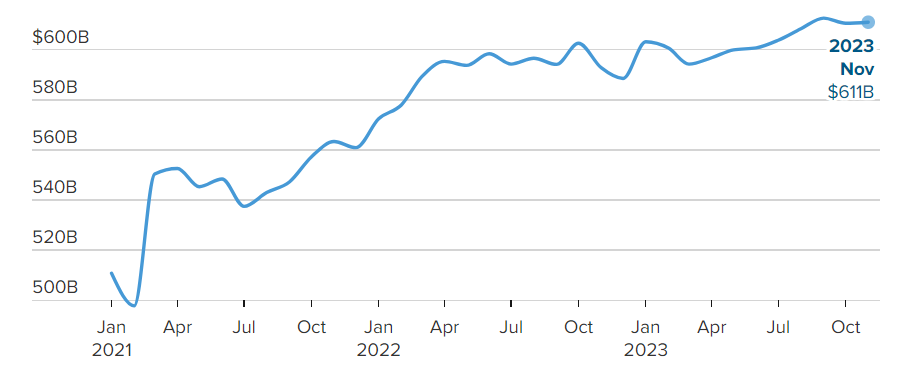

Nevertheless, none of those worries materialized. In fact, despite numerous economic challenges, U.S. consumers were unfazed by their spending, as seen by monthly advanced retail sales that stayed over the $600 million barrier for the majority of 2023.

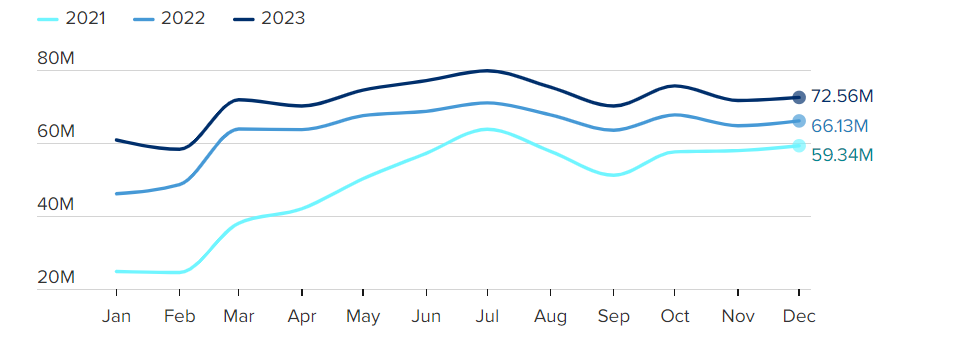

Advance retail sales in the U.S.

These nine further graphs illustrate how the economy performed in 2023.

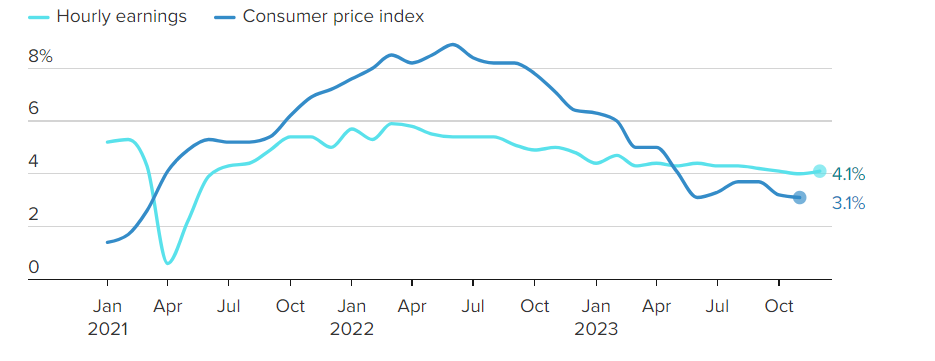

Inflation, wages and spending

Although American consumers are still concerned about inflation, the pace of inflation decreased dramatically in 2023. Over the course of the year, salaries increased more quickly than price rises.

Average hourly earnings in the U.S. and consumer price index

Year-over-year percent change

Consumers in the US were eager to spend money, especially on experiences. Travel officially made a comeback in 2023, with the Thanksgiving holiday setting US records. In November and December, the Transportation Security Administration examined about 150 million people at airports across the United States.

Travelers screened at U.S. airports

Monthly totals

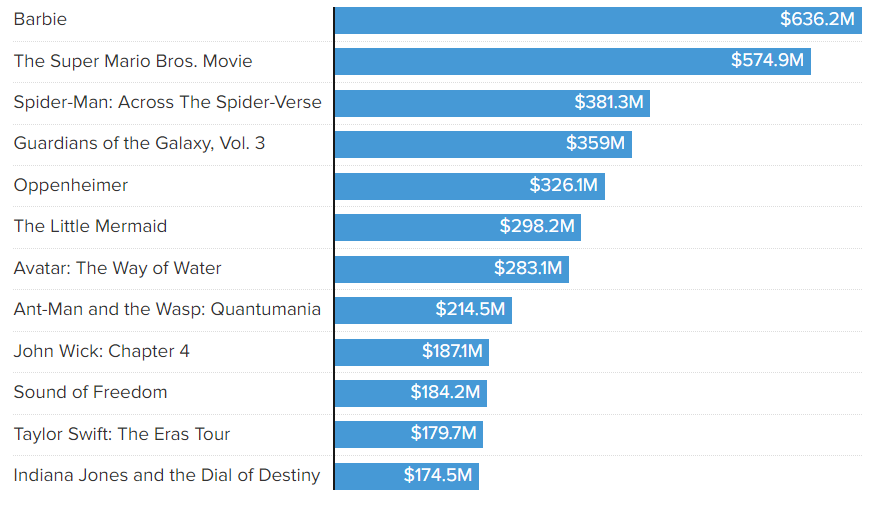

Americans also spent money on entertainment. With massive hits including “Barbie,” “Oppenheimer,” and Taylor Swift’s concert film The Eras Tour, the U.S. box office rebounded significantly from its Covid-19 epidemic lows in 2018.

Top 12 films of 2023

Domestic box office

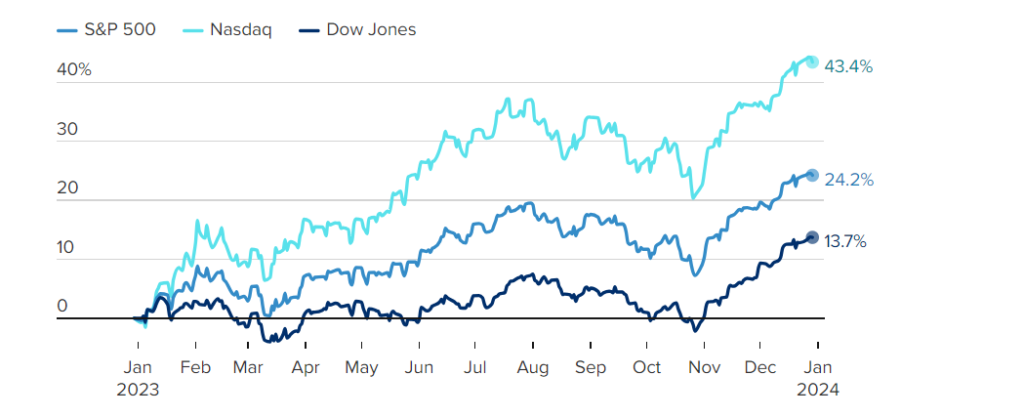

Markets

Tech companies led the way as all three major U.S. indices concluded the year with significant gains. For the Dow Jones Industrial Average, the Nasdaq Composite, and the S&P 500, it was some of their strongest growth in recent memory.

Major U.S. indexes

Performance in 2023

Even digital assets, which had reached a low point in November of the previous year, witnessed a recovery in 2023. By year’s end, bitcoin values had nearly tripled from their previous low.

Bitcoin Price in USD

Interest rates and housing

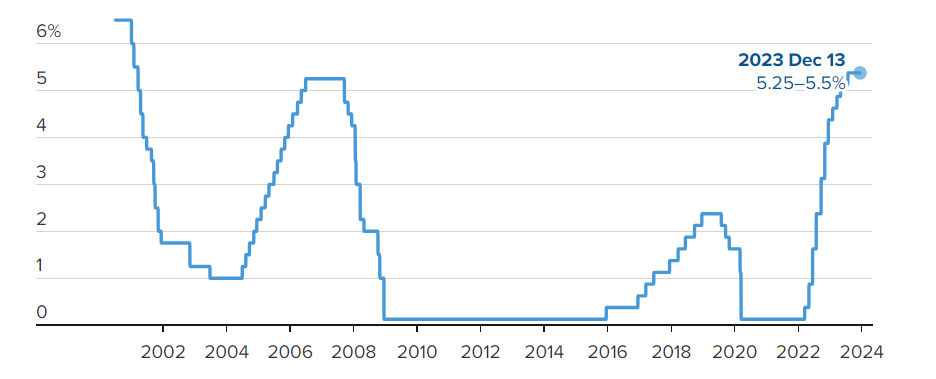

The Federal Reserve moderated its battle on inflation after its unprecedented rate hikes in 2022 and only hiked rates at four of its eight meetings in 2023. Even though the Fed’s target range for interest rates is at its highest point since 2006, observers of the Fed are hopeful that rate reduction may occur in 2024 based on recent remarks made by Chair Jerome Powell.

Federal funds rate increases since 2022

Federal funds target rate

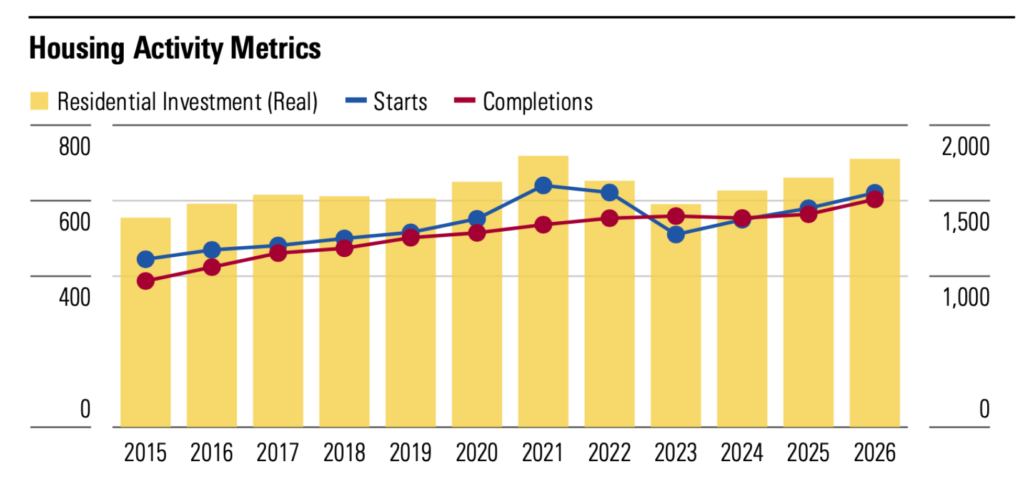

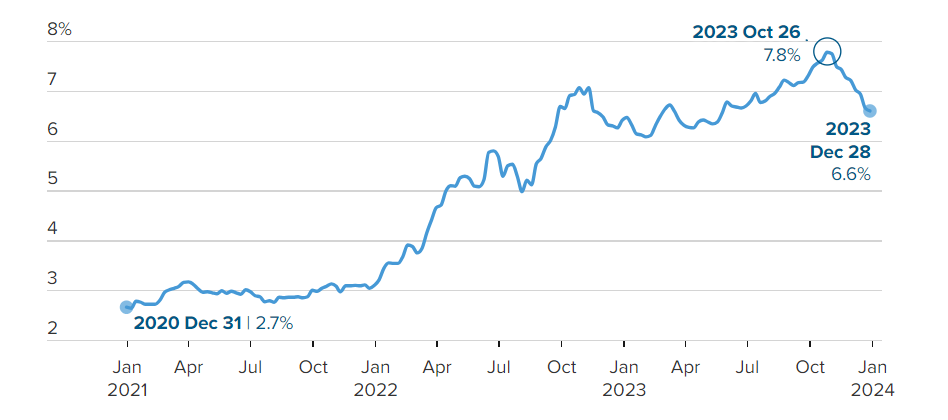

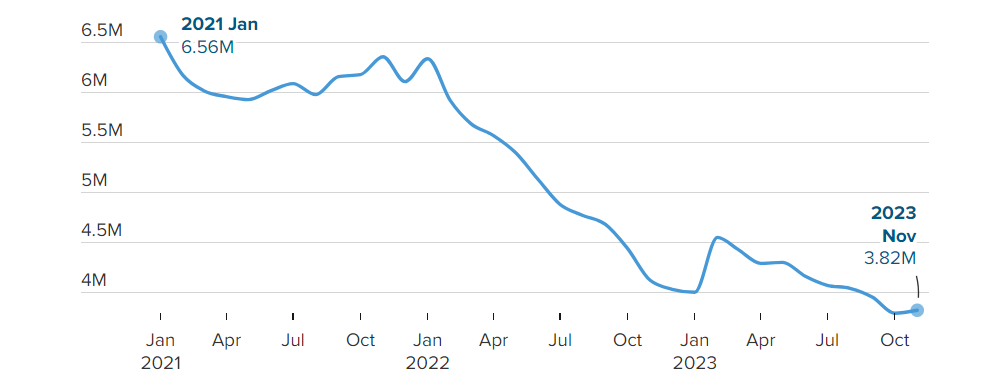

However, there were certain instances where customers had issues. The cost of mortgages is still very high. Current home sales are still low, and the average 30-year fixed rate in October was over three times what it was at the end of 2020, despite a considerable decrease in rates by year’s end, per data from the National Association of Realtors. Until new housing inventory becomes available, those problems are probably going to continue until 2024.

Average 30-year fixed rate mortgage in the U.S.

Existing home sales in the U.S.

Click here to check out the latest post on Instagram.

Also read: Interim Budget 2024: In FY25, The Government Is Anticipated To Maintain Its Focus On PSU Stake Sales

image source: google