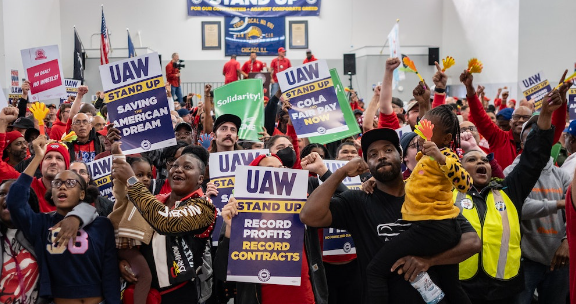

UAW Strike: A tentative agreement reached Monday between the UAW and General Motors ended heated discussions and nearly six weeks of labor strikes against Detroit automakers.

- IMPORTANT NOTES

- A tentative agreement reached Monday between the United Auto Workers and General Motors ended heated discussions and almost six weeks of labor strikes against Detroit automakers.

- To ratify the tentative agreements, UAW members at GM, Ford Motor, and Stellantis must still vote.

- At the end of bargaining, Fain and the union are apparent victors, but others, such as Tesla and President Joe Biden, may also come out victorious.

UAW President Shawn Fain warned of a more militant union going into the discussions, but few, if any, anticipated the union to outmaneuver the employers as effectively as it did, resulting in record settlements for 146,000 UAW members with GM, Ford Motor, and Stellantis. While the finalized accords are still being finalized, they set 25% compounded hikes over 412 years, including an 11% boost upon ratification; reinstatement of cost-of-living adjustments; increased 401(k) corporate contributions; and expanded profit-sharing bonuses.

To ratify the tentative accords, UAW members must still vote. Local union leaders must also ratify the accords in the situations of GM and Stellantis before member voting. At the end of bargaining, Fain and the union are apparent victors, but others, such as Tesla and President Joe Biden, may also come out victorious. Automakers, as well as potential investors, are among the losers, as are electric car ambitions.

“There are many winners in this.” “Of course, the UAW members are number one,” said Art Wheaton, a labor expert at Cornell University’s The Worker Institute. “It was far more than I expected or imagined possible… “That’s a home run.”

Winner: Shawn Fain

During the talks, Fain became the UAW’s face, using broad talking points like fighting against billionaires, workers’ rights, and rebuilding the middle class to successfully bring national attention to the union’s talks with Detroit automakers. Fain is also the face of success, thanks to his harsh speech and frequent live updates throughout the process.

Loser: Big Three

The “Big Three” Detroit automakers misjudged Fain and the union’s approach, which included unprecedented, targeted strikes that kept the automakers on edge and helped the union gain control over the businesses. As a result, union personnel received record contracts that extracted more from employers than many expected prior to the talks.

Potential winner: UAW organizing

Fain stated on Sunday that the UAW intends to utilize these record settlements to help its beleaguered organizing efforts, including at auto companies other than the three Detroit automakers, citing discussions with the “big five or big six” automakers. In the next years, it will be established whether the UAW can organize foreign automakers in the United States, sometimes known as transplants, or electric vehicle businesses such as Tesla or Rivian.

“They have the best chance now that they’ve had over 40 years to organize the transplants and, perhaps, the nonunion electrical vehicle companies,” Marick Masters, a management professor at Wayne State University in Detroit, said. “But it’s still a steep, uphill battle.”

Loser: Investors

Since the targeted strikes began on September 15, Ford’s stock is down 23%, GM’s is down around 19%, and Stellantis, which has yet to reveal estimated strike costs, is down about 4%. It’s unclear how much the agreements will raise labor expenses for the corporations, which had warned that caving in to all of the union’s requests would hurt their competitiveness and even long-term viability. Deutsche Bank previously predicted that the overall cost increase of the arrangement would be $6.2 billion at Ford, $7.2 billion at GM, and $6.4 billion at Stellantis during the period of the accord.

The UAW agreement, if adopted by members, will add $850 to $900 to the cost of each vehicle manufactured, according to Ford. Ford’s finance head, John Lawler, stated last week that the corporation will try to “find productivity, efficiencies, and cost reductions throughout the company” in order to meet previously announced profitability targets.

Some winners, some losers: UAW members

In general, the UAW members covered by the new contracts are winners; nevertheless, not everyone bore the financial burden of the union’s strikes against Detroit automakers. Plant strikes were gradually included to the union’s targeted, or “stand-up,” strike strategy. Members who participated in the original strikes or were laid off as a result of the work stoppages were not given more than $500 per week in strike pay for nearly six weeks, while others were never called to cease working. Workers will be compensated retroactively for hours performed on and after Oct. 23 under the Ford agreement.

Potential loser: Nonunion plants

In general, the UAW members covered by the new contracts are winners; nevertheless, not everyone bore the financial burden of the union’s strikes against Detroit automakers. Plant strikes were gradually included to the union’s targeted, or “stand-up,” strike strategy. Members who participated in the original strikes or were laid off as a result of the work stoppages were not given more than $500 per week in strike pay for nearly six weeks, while others were never called to cease working. Workers will be compensated retroactively for hours performed on and after Oct. 23 under the Ford agreement.

Loser: EVs

To balance growing labor costs and address slower-than-expected demand for electric vehicles, Ford and GM each announced delays in production or investments for EVs. GM has said it will delay at least three models while also increasing electric truck production in Michigan by at least a year until late-2025, while Ford announced last week that it would postpone $12 billion in planned spending on new EV manufacturing capacity. Stellantis, which has made major investments in plug-in hybrid electric vehicles for the United States, has made no significant adjustments to its EV ambitions. “Clearly, the union came out ahead,” said Masters. “Companies will be able to survive the strike and be able to survive the rise in labor costs. But I’m not sure if they’ll be able to compete in the market for electric automobiles.”

Potential winner: Tesla

Slower EV rollouts may give Tesla more time to compete in the market with its current and planned offerings. The market share of EV leader Tesla has dropped in recent quarters due to growing rivalry, particularly in luxury vehicles, and Detroit automakers were expected to enhance competitiveness in lower-priced models.

“It remains to be seen whether or not [the Detroit automakers are] going to be able to enter the fray with profitable vehicles, electric vehicles, in time to beat the competition and remain profitable on a scale that will enable them to endure as stand-alone entities do,” Masters said in a statement.

Winner: Biden

In a historic gesture, Biden opted to walk the picket line alongside UAW members to express his support and back up his claim of being the “most pro-union president in American history.” While the UAW has yet to re-endorse Biden, the union’s support may persuade it to do so in the future. It might potentially affect key blue-collar voters in the Midwest ahead of the presidential race in 2024. After speaking with Fain on Monday, Biden praised the UAW’s agreements with Detroit automakers.

“These record agreements reward autoworkers who gave up much to keep the industry working and going during the financial crisis more than a decade ago,” Biden said during a speech at the White House. “These agreements ensure that the Big Three can still lead the world in quality and innovation.”

Frequently asked questions

Did UAW strike end?

Oct 30 – General Motors (GM.N) and the United Auto Workers (UAW) reached a tentative agreement on Monday, bringing an end to the union’s historic six-week campaign of synchronized strikes that resulted in record pay raises for workers at the Detroit Three automakers.

Is the Stellantis strike over?

Stellantis and Canadian unionized autoworkers signed a tentative contract deal Monday morning, putting a stop to a brief walkout that began at midnight. Why it is significant: The provisional agreement reached by the automaker and the union, Unifor, covers approximately 8,200 Stellantis employees.

What is the UAW agreement?

The agreement restores important benefits lost during the Great Recession, like as Cost-of-Living Allowances and a three-year salary Progression, while also eliminating union contentious salary tiers. It enhances retirement for current retirees, those with pensions, and those with 401(k) plans.

Who owns Stellantis stock?

Stellantis (STLA) stock is owned by a combination of institutional, retail, and individual investors. Institutional Investors own around 15.87% of the company’s stock, Insiders own 0.11%, and Public Companies and Individual Investors own 84.02%.

Click here to learn about Stellantis.

image source: google