Dive into the nuances between cost and price to make informed decisions. Learn how they impact your choices.

Introduction

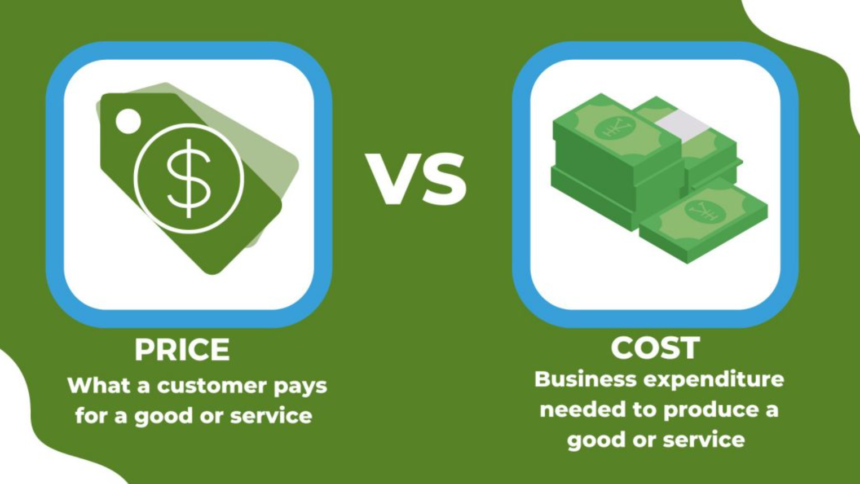

In the world of economics and finance, the terms “cost” and “price” are often used interchangeably, yet they hold distinctive meanings that are crucial to understand, especially in business. While both are associated with the value of goods and services, their implications diverge significantly. It’s imperative to grasp the disparity between these two terms to make informed decisions, particularly when engaging in commerce, investments, or financial planning.

ALSO READ: Toshiba Delisted After 74 Years And Now Confronts A New Era With New Owners

Cost: Unveiling the True Expenses

Definition of Cost

Cost represents the total expenditure incurred in the production of goods or services. It encompasses various elements, including raw materials, labor, overhead expenses, and any other inputs utilized in the manufacturing or provision of a product or service. In business, understanding cost is pivotal as it aids in determining the profitability of a venture and strategizing for efficient operations.

Types of Costs

1. Fixed Costs

Fixed costs remain constant regardless of the volume of production or services rendered. Expenses like rent, insurance premiums, and salaries fall under this category. Understanding fixed costs is essential for businesses to calculate break-even points and establish pricing strategies.

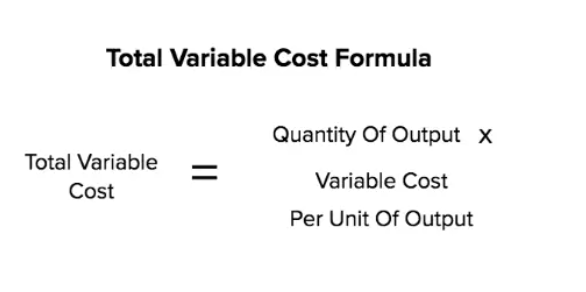

2. Variable Costs

Variable costs fluctuate with the quantity of goods produced or services provided. Expenses such as raw materials, direct labor, and utilities belong to this category. Managing variable costs is crucial for optimizing production and maximizing profitability.

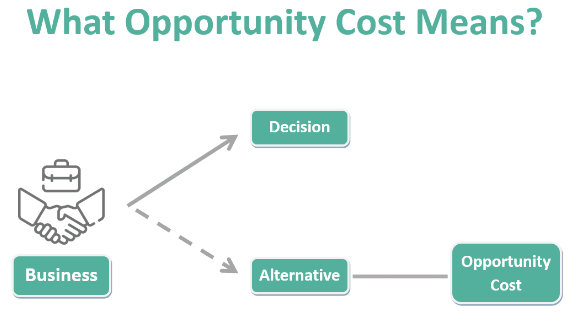

3. Opportunity Costs

Opportunity costs denote the potential benefits foregone by choosing one alternative over another. It’s the value of the next best alternative that must be sacrificed when a decision is made. Businesses need to consider opportunity costs when evaluating choices to make optimal decisions.

Price: Determining Market Value

Definition of Price

Price, on the other hand, refers to the amount of money a buyer is willing to pay for a particular product or service. It’s the value assigned to a commodity in the marketplace, influenced by factors such as demand, supply, competition, and perceived value. Understanding price is crucial for setting competitive rates and maximizing revenue.

Factors Affecting Price

1. Market Demand

The level of demand for a product or service greatly impacts its price. When demand surpasses supply, prices tend to increase, and vice versa. Monitoring market trends and consumer behavior is vital in determining optimal pricing strategies.

2. Competition

Competition within an industry plays a pivotal role in pricing decisions. Businesses often adjust their prices based on competitors’ offerings to maintain market share and stay competitive.

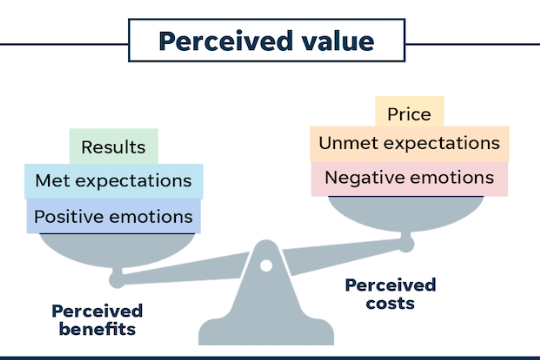

3. Perceived Value

Consumers assess the value of a product or service concerning its quality, features, and benefits. Businesses can leverage perceived value to justify higher prices and differentiate themselves in the market.

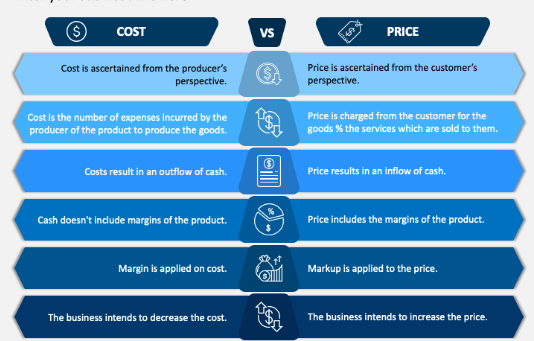

Key Differences Between Cost and Price

While both cost and price are fundamental in the realm of commerce, their distinctions are substantial:

- Cost is the expense incurred in production, whereas price is the value assigned to a product or service in the market.

- Cost focuses on internal expenses, while price considers external market factors.

- Cost is more tangible and directly calculable, whereas price is influenced by subjective perceptions and market dynamics.

Understanding these disparities is pivotal for businesses to devise effective pricing strategies, optimize operations, and maximize profitability.

Conclusion

In summary, comprehending the distinction between cost and price is indispensable for businesses and individuals navigating economic decisions. While cost represents the internal expenses incurred, price signifies the external value assigned in the market. Both elements play a pivotal role in determining the success and profitability of ventures, guiding pricing strategies, and making informed financial decisions.

Click here, to check out the latest post on Instagram.

Also read: BT500 Wealth Creators Summit: What Is Driving India’s Improved Corporate Governance Practices?

image source: google