The majority of telecom firms and the media still lack a compelling growth story for 2024.

- Important Points

- Transformative agreements may be impeded until 2025 by concerns about interest rates and regulations.

- For traditional media, the upcoming year may make or break its ability to continue operating or continue to be vulnerable.

It’s common for people to feel hopeful and optimistic about the new year. Executives, investors, and workers in the telecom and entertainment sectors are not going to be happy in 2024. That might be too snarky. There will be improvements in certain areas. The strikes by writers and actors have ended. As global TV ad income is expected to drop 18% this year, the 2024 U.S. presidential race might help increase advertising spending, according to media investment group GroupM.

To increase free cash flow and reduce debt, businesses like Disney and Warner Bros. Discovery removed hundreds of positions and drastically reduced content prices. That can encourage investors to have higher hopes for their company’s success in the upcoming year. Disney recently announced the restoration of its dividend for early 2024, following a more than three-year suspension.

ALSO READ: Contribution Margin: What It Is, How To Calculate It, And Why It Is Required

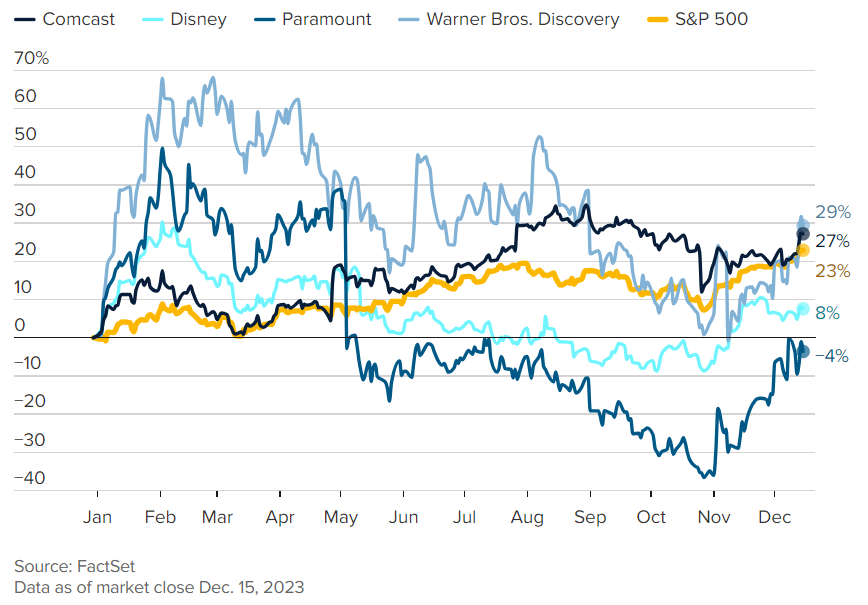

Even then, traditional media firms like Disney, Warner Bros. Discovery, Paramount Global, and Comcast’s NBCUniversal are attempting to ascertain what investors desire after retreating from the story of growing subscription streaming video that dominated 2020 and 2021. Though not by much, Warner Bros. Discovery and Comcast have beaten the S&P 500 in 2023. Paramount Global and Disney have both underperformed.

Media companies’ performance in 2023

Three main areas of uncertainty seem to constitute the prevailing storyline for 2024: interest rates, regulatory policy, and chances for general growth. To advance, the business needs greater clarity on all three issues by 2025, according to Corey Martin, managing partner of the entertainment law firm Granderson Des Rochers. According to Martin, the coming year will likely be characterized more by getting ready for action than by real transformation. According to Martin, 2024 will likely be a year of ongoing instability. “It’s actually just the continuation of a pattern that started around the middle of 2022.”

The Jerome Powell factor

Rates have decreased after the benchmark 10-year Treasury yield reached a 16-year high in October, coinciding with the Federal Reserve’s announcement that it intends to make many reductions in 2024 and beyond. The Federal Reserve’s overnight lending rate is currently 5.25% to 5.5%, which is a considerable increase from the rates that have been in place since the 2008 financial crisis.

Rate reductions in 2019 may cause transformative deal-making to wait until 2025. Companies in the media and technology sectors would prefer to wait for less expensive financing if they wish to buy sizable assets but lack the necessary funds.

“I had lunch with a major studio CEO in late November, and he expressed uncertainty about operating in this monetary policy environment,” Martin recalled. What is the capital cost? Is it wiser for me to hold off until 2025, when I will know for sure if interest rates will drop or stay the same?

However, significant agreements may be revealed in 2024 with the understanding that they will take a year and a half to close. Companies may then place bets on interest rates decreasing to levels more consistent with the previous ten years.

The controlling holding company of Paramount Global, National Amusements, has been the subject of talks Shari Redstone has been holding for the past few months, according to people familiar with the situation who asked not to be named since the talks are private. Regardless of the macroeconomic climate, if that merger closes in 2024, it may spark a wave of strategic deals across the media and entertainment sectors, including the sale of aging cable networks to private equity companies. No comments were offered by National Amusements.

Biden, Trump, and the annoyance of regulations

In private conversations, three CEOs of significant media and telecom firms expressed their hope for new regulatory policies to facilitate the necessary consolidation, maybe in the form of a change in presidential administration. Companies like Sinclair, Tegna, Nexstar, and Gray Television are prevented from merging or discouraged from doing so by the regulations that now cap regional broadcast station ownership.

There’s also fear that the merger of cable and cellular assets won’t sit well with Federal Trade Commission Chair Lina Khan or any other regulatory officials that President Joe Biden appoints in 2024 or later. Although both are owned by European firms, cable ownership remains distinct from that of cellular network operators in the United States. Khan would probably view this as anti-competitive since it would strengthen corporate pricing power and eliminate competition by combining firms like Comcast and Charter with AT&T, Verizon, or T-Mobile.

The current tango between Warner Bros. Discovery, Paramount Global, and NBCUniversal is another. It’s a common assumption among media observers that two of those three businesses may combine, leaving the third without a partner in dancing. It is yet unknown how regulators would react to a combination of those assets. Without selling up one of the networks, a proposal between NBCUniversal and Paramount Global that would combine broadcast networks NBC and CBS under one corporate roof appears to be doomed by regulations.

“The industry will undergo one last round of consolidation,” stated John Harrison, the leader of EY America’s media and entertainment division. From a structural standpoint, the economics of streaming are unsound. Since linear TV is coming to an end, businesses need to get their pricing structures straight. However, given the speed at which the disruption is occurring and the 18- to 24-month review period required to have a deal authorized, there is reluctance to move forward with anything significant.

There might not be much comfort if Biden and former President Donald Trump are the two presidential nominees. Before a judge reversed the ruling, Trump’s Department of Justice blocked AT&T’s acquisition of Time Warner. Additionally, Trump has a history of openly criticizing Comcast, the parent corporation of NBC, and CEO Brian Roberts. As recently as last month, Trump called Roberts a “slimeball” in a post on the former president’s social media platform, Truth Social.

Paradoxically, some businesses might become less concerned about regulatory concerns as a result. Should executives see hindrances from both Democratic and Republican administrations, corporate boards may opt to authorize the acceleration of transformative transactions sooner rather than later. In the event that a deal is stopped, they may pursue legal action.

Where has the growth gone?

There hasn’t been a consistent growth story for the media and entertainment industries since the 2022 “Great Netflix Correction.” Concerningly, cable operator stocks are still rising and falling in response to increases or decreases in residential internet; this trend is expected to stop growing in 2023. Even though AT&T and Verizon have added fixed wireless users this year and probably will again next year, their stock prices have been stagnant for almost ten years.

This year, traditional TV subscribers fell by the millions once more. Advertising spending will decrease in tandem with a decrease in eyeballs. For the majority of the big streaming services, 2019 will probably be yet another year of industry losses. Disney, Paramount Global, and NBCUniversal have all projected 2025 as the first full year of profitability for their major streaming services.

In 2023, media leaders reduced their expenditures on content and resized their companies to boost the profitability of their main streaming services. David Zaslav, the CEO of Warner Bros. Discovery, changed his compensation package to include a bonus that is based on his company’s ability to generate free cash flow and repay debt. Disney revealed last month that it will save $7.5 billion this year, $2 billion more than its initial goal of $5.5 billion.

However, the industry is still locked at low valuations compared to two or three years ago. Disney is getting ready for a proxy fight with former CFO Jay Rasulo and activist investor Nelson Peltz, who want to run for board seats, citing Disney’s dismal results when compared to the S&P 500. The CEO of Disney, Bob Iger, and the board of directors of Peltz’s Trian Fund Management “appear to have no conviction that things will get better,” the statement reads.

Beyond financial measures, a number of executives revealed in private that legacy media businesses’ employee morale is becoming a growing source of concern. It’s challenging to create cultures of affluence and keep top personnel in an environment of extreme uncertainty, few clear growth possibilities to spark excitement, and widespread layoffs. One CEO mentioned that he’s been hearing from colleagues more and more that it’s just not as fun to operate media and entertainment companies as it was a decade or two ago. The year 2024 ought to be a turning point for the sector. Conditions will either get better or they won’t. In 2025, expect fireworks if they don’t.

Click here, to check out the latest post on Instagram.

Also read: BT500 Wealth Creators Summit: What Is Driving India’s Improved Corporate Governance Practices?

image source: google